Dollar General 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169

(b) Related Party Transactions. We describe below the transactions that have

occurred since the beginning of fiscal 2008, and any currently proposed transactions, that involve

Dollar General and exceed $120,000, and in which a related party had or has a direct or indirect

material interest.

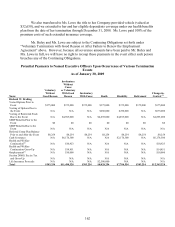

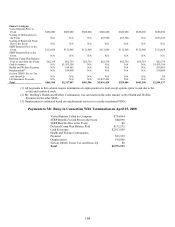

Equity Investment by Messrs. Vasos, Flanigan and Ravener. In fiscal 2008, three of

our executive officers, Todd Vasos, Executive Vice President, Division President, Chief

Merchandising Officer, John Flanigan, Senior Vice President of Global Supply Chain, and

Robert Ravener, Senior Vice President and Chief People Officer, purchased shares of Dollar

General common stock that were issued pursuant to our 2007 Stock Incentive Plan, as follows:

Name

Effective Date of

Purchase

Number of

Shares

Per Share

Purchase Price*

Aggregate

Purchase Price

Mr. Vasos 12/19/2008 130,000 $ 5.00 $ 650,000

Mr. Flanigan 08/28/2008 40,000 $ 5.00 $ 200,000

Mr. Ravener

08/28/2008

25,000

$ 5.00

$ 125,000

12/19/2008

35,000

$ 5.00

$ 175,000

* Equals the per share fair market value of our common stock on the effective date of purchase as

determined in good faith by our Board of Directors considering the factors referenced in, or similar to

those referenced in, Footnote 1 to the table entitled “Option Exercises and Stock Vested During Fiscal

2008” in Item 11 above.

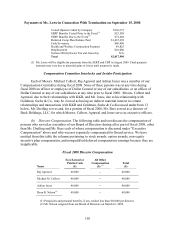

In addition, in August 2008 and December 2008, each of Mr. Flanigan and Mr. Ravener

respectively indicated an intention to invest an additional $50,000 and $200,000 in Dollar

General common stock in May 2009. The number of shares each of Messrs. Flanigan and

Ravener will receive in connection with such investment will be determined based upon the per

share fair market value of our common stock on the date of such investment in May 2009 as

determined by our Board of Directors. Upon consummation of his investment in May 2009, Mr.

Flanigan will be eligible to receive an additional grant of 80,000 stock options issued pursuant to

our 2007 Stock Incentive Plan, subject to the approval of our Compensation Committee.

The investments set forth in the table above were a prerequisite to the eligibility of these

executives to receive grants of stock options pursuant to our 2007 Stock Incentive Plan (our

Compensation Committee granted Messrs. Vasos, Flanigan and Ravener 875,000, 320,000, and

400,000 options, respectively, during fiscal 2008, with a per share exercise price of $5.00). The

shares purchased by Messrs. Vasos, Flanigan and Ravener, along with any shares such

individuals may otherwise acquire (such as upon exercise of the stock options referenced above)

are subject to certain transfer limitations and repurchase rights by Dollar General as set forth in a

Management Stockholder’ s Agreement between us and each such executive officer.

Calls of Equity Held by Former Executive Officers. In connection with the separation

from our employment of Mr. Wayne Gibson, our former Senior Vice President of Dollar General

Markets and Shrink, in June 2008 we paid Mr. Gibson an aggregate of $348,704 (less applicable

withholding for taxes and other payroll deductions) in connection with the exercise of our call

right under our Management Stockholder’ s Agreement with Mr. Gibson to purchase all of our