Dollar General 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

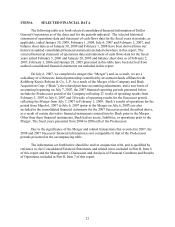

22

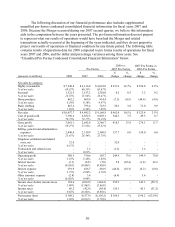

(1) Includes the results of Buck for the period prior to the Merger with and into Dollar General Corporation from March 6, 2007 (its formation)

through July 6, 2007 and the post-Merger results of Dollar General Corporation for the period from July 7, 2007 through February 1, 2008.

(2) Includes the effects of certain strategic merchandising and real estate initiatives that resulted in the closing of approximately 460 stores and

changes in the Company’s inventory management model which resulted in greater inventory markdowns than in previous years.

(3) The fiscal year ended February 3, 2006 was comprised of 53 weeks.

(4) For fiscal periods ending after January 28, 2005, same-store sales have been calculated based upon stores that were open at least 13 full

fiscal months and remained open at the end of the reporting period. For fiscal periods ending on or before January 28, 2005, same-store

sales include stores that were open both at the end of the reporting period and at the beginning of the preceding fiscal year. The Company

excludes the sales in the 53rd week of a 53-week year from the same-store sales calculation.

(5) Net sales per square foot was calculated based on total sales for the preceding 12 months as of the ending date of the reporting period

divided by the average selling square footage during the period, including the end of the fiscal year, the beginning of the fiscal year, and the

end of each of the Company’ s three interim fiscal quarters. For the period from February 3, 2007 through July 6, 2007, average selling

square footage was calculated using the average of square footage as of July 6, 2007 and as of the end of each of the four preceding

quarters. For the fiscal year ended February 3, 2006, net sales per square foot was calculated based on 52 weeks’ sales.

Successor

Predecessor

Year Ended

Year Ended

(Amounts in millions, excluding

number of stores, selling square feet,

and net sales per square foot)

January 30,

2009

March 6,

2007

through

February 1,

2008(1)(2)

February 3,

2007

through

July 6,

2007(2)

February 2,

2007(2)

February 3,

2006(3)

January 28,

2005

Statement of Operations Data:

Net sales

$

10,457.7

$

5,571.5

$

3,923.8

$

9,169.8

$

8,582.2

$

7,660.9

Cost of goods sold

7,396.6

3,999.6

2,852.2

6,801.6

6,117.4

5,397.7

Gross profit

3,061.1

1,571.9

1,071.6

2,368.2

2,464.8

2,263.2

Selling, general and

administrative

2,448.6

1,324.5

960.9

2,119.9

1,903.0

1,706.2

Litigation settlement and related

costs, net 32.0 - - - - -

Transaction and related costs

-

1.2

101.4

-

-

-

Operating profit 580.5 246.1 9.2 248.3 561.9 557.0

Interest income

(3.1)

(3.8)

(5.0)

(7.0)

(9.0)

(6.6)

Interest expense

391.9

252.9

10.3

34.9

26.2

28.8

Other (income) expense

(2.8)

3.6

-

-

-

-

Income (loss) before income taxes

194.4

(6.6)

4.0

220.4

544.6

534.8

Income tax expense (benefit)

86.2

(1.8)

12.0

82.4

194.5

190.6

Net income (loss)

$

108.2

$

(4.8)

$

(8.0)

$

137.9

$

350.2

$

344.2

Statement of Cash Flows Data:

Net cash provided by (used in):

Operating activities

$

575.2

$

239.6

$

201.9

$

405.4

$

555.5

$

391.5

Investing activities

(152.6)

(6,848.4)

(66.9)

(282.0)

(264.4)

(259.2)

Financing activities

(144.8)

6,709.0

25.3

(134.7)

(323.3)

(245.4)

Total capital expenditures

(205.5)

(83.6)

(56.2)

(261.5)

(284.1)

(288.3)

Other Financial and Operating

Data:

Same store sales growth (4) 9.0% 1.9% 2.6% 3.3% 2.2% 3.2%

Same store sales (4)

$

10,118.5

$

5,264.2

$

3,656.6

$

8,327.2

$

7,555.8

$

6,589.0

Number of stores included in same

store sales calculation

8,153

7,735

7,655

7,627

7,186

5,932

Number of stores (at period end)

8,362

8,194

8,205

8,229

7,929

7,320

Selling square feet (in thousands at

period end) 58,803 57,376 57,379 57,299 54,753 50,015

Net sales per square foot (5)

$

179.7

$

165.4

$

163.9

$

162.6

$

159.8

$

159.6

Highly consumable sales

69.3%

66.4%

66.7%

65.7%

65.3%

63.0%

Seasonal sales

14.6%

16.3%

15.4%

16.4%

15.7%

16.5%

Home product sales

8.2%

9.1%

9.2%

10.0%

10.6%

11.5%

Basic clothing sales

7.9%

8.2%

8.7%

7.9%

8.4%

9.0%

Rent expense

$

389.6

$

214.5

$

150.2

$

343.9

$

312.3

$

268.8

Balance Sheet Data (at period

end):

Cash and cash equivalents and short-

term investments $ 378.0 $ 119.8 $ 219.2 $ 209.5 $ 275.8

Total assets

8,889.2

8,656.4

3,040.5

2,980.3

2,841.0

Total debt

4,137.1

4,282.0

270.0

278.7

271.3

Total shareholders’ equity

2,831.7

2,703.9

1,745.7

1,720.8

1,684.5