Dollar General 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.142

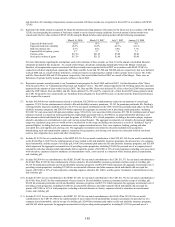

and the Board believes that they are fair and appropriate given CEO compensation and benefits

at comparable companies and given Mr. Dreiling’ s experience and leadership ability. These

arrangements were also necessary to entice Mr. Dreiling to resign from his previous employer

and to give him the opportunity to offset the potential financial gain he would be foregoing by

leaving that employer.

Severance Agreements

As noted above, we have an employment agreement with each of our named executive

officers that among other things provide for such officer’ s rights upon a termination of

employment. We believe that reasonable severance benefits are appropriate to protect the named

executive officer against circumstances over which he or she does not have control and as

consideration for the promises of non-competition, non-solicitation and non-interference that we

require in our employment agreements.

All of our severance provisions in the event of a change-in-control operate under a double

trigger, requiring both a change-in-control and a termination event, except for the provisions

related to long-term equity incentives under our 2007 Plan. Under the 2007 Plan, (1) all time-

vested options will vest and become immediately exercisable as to 100% of the shares of

common stock subject to such options immediately prior to a change-in-control and (2) all

performance–vested options will vest and become immediately exercisable as to 100% of the

shares of common stock subject to such options immediately prior to a change-in-control if, as a

result of the change–in-control, (x) investment funds affiliated with KKR realize a specified

internal rate of return on 100% of their aggregate investment, directly or indirectly, in our equity

securities (the “Sponsor Shares”) and (y) the investment funds affiliated with KKR earn a

specified cash return on 100% of the Sponsor Shares; provided, however, that in the event that a

change-in-control occurs in which more than 50% but less than 100% of our common stock or

other voting securities or the common stock or other voting securities of Buck Holdings, L.P. is

sold or otherwise disposed of, then the performance-vested options will become vested up to the

same percentage of Sponsor Shares on which investment funds affiliated with KKR achieve a

specified internal rate of return on their aggregate investment and earn a specified return on their

Sponsor Shares.

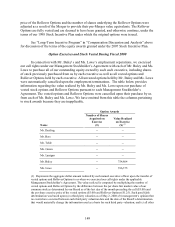

Payments to Mr. Buley and Ms. Lowe in Connection with Employment Separation

Mr. Buley’ s and Ms. Lowe’ s employment with us ended in April 2008 and September

2008, respectively. Payments and other benefits to Mr. Buley and Ms. Lowe in connection with

these employment terminations are itemized under “Potential Payments Upon Termination or

Change-in-Control” below and generally were in accordance with the terms of their employment

agreements. In recognition of her service to Dollar General, we transferred to Ms. Lowe title to

her Company-leased automobile in connection with her separation from our employment. In

addition, we extended health insurance coverage benefits to Ms. Lowe and her eligible

dependents from the date of her employment termination through December 31, 2008. Ms. Lowe

bore the entire cost of this coverage extension.