Dollar General 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

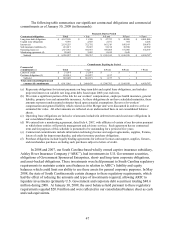

• 100% of the net cash proceeds of all non-ordinary course asset sales or other

dispositions of revolving facility collateral (as defined below) in excess of $1.0

million in the aggregate and subject to our right to reinvest the proceeds; and

• to the extent such extensions of credit exceed the then current borrowing base (as

defined in the senior secured credit agreement for the asset-based revolving credit

facility).

We may be obligated to pay a prepayment premium on the amount repaid under the term

loan facility if the term loans are voluntarily repaid in whole or in part before July 6, 2009. We

may voluntarily repay outstanding loans under the asset-based revolving credit facility at any

time without premium or penalty, other than customary “breakage” costs with respect to LIBOR

loans.

An event of default under the senior secured credit agreements will occur upon a change

of control as defined in the senior secured credit agreements governing our Credit Facilities.

Upon an event of default, indebtedness under the Credit Facilities may be accelerated, in which

case we will be required to repay all outstanding loans plus accrued and unpaid interest and all

other amounts outstanding under the Credit Facilities.

Amortization. Beginning September 30, 2009, we are required to repay installments on

the loans under the term loan credit facility in equal quarterly principal amounts in an aggregate

amount per annum equal to 1% of the total funded principal amount at July 6, 2007, with the

balance payable on July 6, 2014. There is no amortization under the asset-based revolving credit

facility. The entire principal amounts (if any) outstanding under the asset-based revolving credit

facility are due and payable in full at maturity, on July 6, 2013, on which day the commitments

thereunder will terminate.

Guarantee and Security. All obligations under the Credit Facilities are unconditionally

guaranteed by substantially all of our existing and future domestic subsidiaries (excluding certain

immaterial subsidiaries and certain subsidiaries designated by us under our senior secured credit

agreements as “unrestricted subsidiaries”), referred to, collectively, as U.S. Guarantors.

All obligations and related guarantees under the term loan credit facility are secured by:

• a second-priority security interest in all existing and after-acquired inventory,

accounts receivable, and other assets arising from such inventory and accounts

receivable, of our company and each U.S. Guarantor (the “Revolving Facility

Collateral”), subject to certain exceptions;

• a first priority security interest in, and mortgages on, substantially all of our and each

U.S. Guarantor’ s tangible and intangible assets (other than the Revolving Facility

Collateral); and

• a first-priority pledge of 100% of the capital stock held by us, or any of our domestic

subsidiaries that are directly owned by us or one of the U.S. Guarantors and 65% of