Dollar General 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

impairment estimates of $63.5 million and incurred higher markdowns and writedowns on

inventory in the second half of 2006 and in 2007 than in comparable prior-year periods. As a

result of the Merger and in accordance with SFAS 141, the Company’ s inventory balances,

including the inventory associated with this strategic change, were adjusted to fair value and the

related reserve was eliminated.

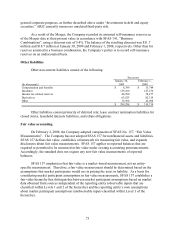

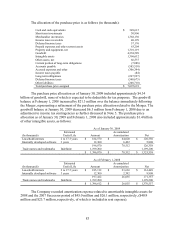

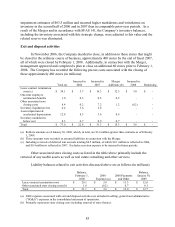

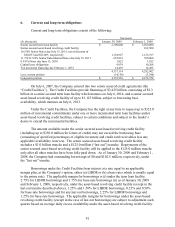

Exit and disposal activities

In November 2006, the Company decided to close, in addition to those stores that might

be closed in the ordinary course of business, approximately 400 stores by the end of fiscal 2007,

all of which were closed by February 1, 2008. Additionally, in connection with the Merger,

management approved and completed a plan to close an additional 60 stores prior to February 1,

2008. The Company has recorded the following pre-tax costs associated with the closing of

these approximately 460 stores (in millions):

Total (a)

Incurred in

2006

Incurred in

2007

Merger

Additions (b)

Incurred in

2008 Remaining

Lease contract termination

costs (c) $

38.1 $ 5.7 $ 16.3 $ 12.3 $ 3.8

$ -

One-time employee

termination benefits

1.0

0.3

0.5

0.2

-

-

Other associated store

closing costs

8.4

0.2

7.2

1.2

(0.2)

-

Inventory liquidation fees

4.4

1.6

2.8

-

-

-

Asset impairment &

accelerated depreciation

12.8

8.3

3.6

0.9

-

-

Inventory markdowns

below cost 8.3 6.7 0.9 0.7 -

-

Total

$

73.0

$

22.8

$

31.3

$

15.3

$

3.6

$

-

(a) Reflects amounts as of January 30, 2009, which, in total, are $3.6 million greater than estimates as of February

1, 2008.

(b) These amounts were recorded as assumed liabilities in connection with the Merger.

(c) Including reversals of deferred rent accruals totaling $0.5 million, of which $0.1 million is reflected in 2006,

and $0.4 million is reflected in 2007. Excludes accretion expense to be incurred in future periods.

Other associated store closing costs as listed in the table above primarily include the

removal of any usable assets as well as real estate consulting and other services.

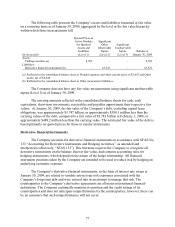

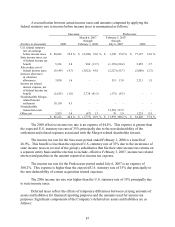

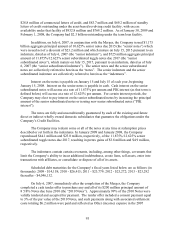

Liability balances related to exit activities discussed above are as follows (in millions):

Balance,

February 1,

2008

2008

Expenses (a)

2008 Payments

and Other

Balance,

January 30,

2009

Lease contract termination costs

$

20.1

$

3.8

$

11.3

$

12.6

Other associated store closing costs (b)

1.0

(0.2)

0.7

0.1

Total

$

21.1

$

3.6

$

12.0

$

12.7

(a) 2008 expenses associated with exit and disposal activities are included in selling, general and administrative

(“SG&A”) expenses in the consolidated statement of operations.

(b) Primarily represents store closing costs including removal of store fixtures.