Dollar General 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.113

net of insurance proceeds and increasing operating profit by the incremental $2.5 million. These

amounts are reflected as Litigation settlement and related costs, net in the respective quarters.

As discussed in Note 3, in the fourth quarter of 2008, the Company recorded net

additional pre-tax expenses of $3.3 million related to underperforming stores closed in fiscal

years 2006 and 2007. These additional expenses are related to re-evaluation of the existing lease

contract termination liabilities based on current market conditions and are reflected as SG&A

expense.

As discussed in Note 6, in the fourth quarter of 2008, the Company repurchased $44.1

million of the 11.875%/12.625% senior subordinated toggle notes due 2017 resulting in a net

gain of $3.8 million which is recognized as Other (income) expense.

As discussed in Note 8, in the fourth quarter of 2008, the Company recorded an $8.6

million charge included in Cost of goods sold related to the markdown of certain products

covered by the Consumer Products Safety Improvement Act of 2008, and reversed $5.0 million

of SG&A expenses originally recorded in fiscal 2007 related to certain distribution center lease

contingencies.

As discussed in Note 2, in the Predecessor period ended July 6, 2007, the Company

recorded transaction and other costs related to the Merger of $56.7 million and share-based

compensation expense related directly to the Merger of $39.4 million as discussed in Note 10. As

discussed in Note 2, in the Successor period ended August 3, 2007, the Company recorded

transaction and other costs related to the Merger of $5.6 million, a loss on debt retirement related

to the Merger of $6.2 million as discussed in Note 6; a contingent loss related to certain DC

leases of $8.6 million as discussed in Note 8; and a gain on certain interest rate swaps discussed

in Note 7 of $6.8 million.

In the third quarter of 2007, the Company recorded an additional contingent loss related

to certain DC leases of $3.4 million as discussed in Note 8.

As discussed in Note 6, in the fourth quarter of 2007, the Company recorded a gain on

debt retirement of $4.9 million.

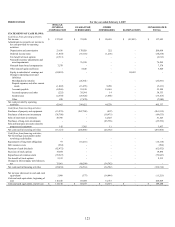

16. Guarantor subsidiaries

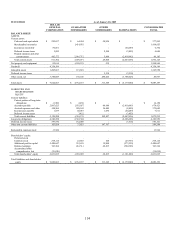

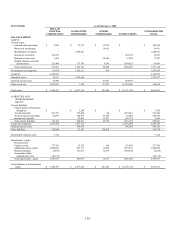

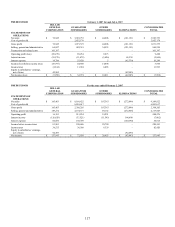

Certain of the Company’ s subsidiaries (the “Guarantors”) have fully and unconditionally

guaranteed on a joint and several basis the Company's obligations under certain outstanding debt

obligations. Each of the Guarantors is a direct or indirect wholly-owned subsidiary of the

Company. The following consolidating schedules present condensed financial information on a

combined basis, in thousands.