Dollar General 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

well as $39.4 million of compensation expense in the Predecessor period related to stock options,

restricted stock and restricted stock units which were fully vested immediately prior to and as a

result of the Merger.

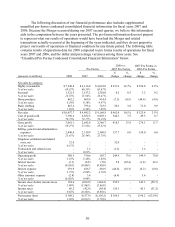

Interest Income. Interest income consists primarily of interest on investments. The

decrease in interest income in 2008 compared to the 2007 periods was a result of lower interest

rates, partially offset by higher investments. In the 2007 periods (primarily the 2007 Predecessor

period) we had higher levels of cash and short term investments on hand as compared to 2006.

Interest Expense. The significant increase in interest expense in 2008 and the 2007

Successor period subsequent to the Merger is due to interest on long-term obligations incurred to

finance the Merger. See further discussion under “Liquidity and Capital Resources” below. We

had outstanding variable-rate debt of $623 million and $787 million, after taking into

consideration the impact of interest rate swaps, as of January 30, 2009 and February 1, 2008,

respectively. The remainder of our outstanding indebtedness at January 30, 2009 and February 1,

2008 was fixed rate debt.

Interest expense in 2008 was less than 2007 pro forma interest expense due to lower

borrowing amounts, specifically on the revolving credit agreement and senior subordinated

notes, along with lower interest rates. Pro forma interest expense for both 2007 and 2006 was

approximately $437 million.

Other (Income) Expense. In 2008, we recorded a gain of $3.8 million resulting from the

repurchase of $44.1 million of our senior subordinated notes, offset by expense of $1.0 million

related to hedge ineffectiveness related to certain interest rate swaps.

During the 2007 Successor period, we recorded an unrealized loss of $4.1 million related

to the change in the fair value of interest swaps prior to the designation of such swaps as cash

flow hedges in October 2007, offset by earnings of $1.7 million under the contractual provisions

of the swap agreements. Also during the 2007 Successor period, we recorded $6.2 million of

expenses related to consent fees and other costs associated with a tender offer for certain notes

payable maturing in June 2010 (“2010 Notes”). Approximately 99% of the 2010 Notes were

retired as a result of the tender offer. The costs related to the tender of the 2010 Notes were

partially offset by a $4.9 million gain in the 2007 Successor period resulting from the repurchase

of $25.0 million of our senior subordinated notes.

Income Taxes. The effective income tax rates for 2008, the 2007 Successor and

Predecessor periods and 2006 were an expense of 44.4%, a benefit of 26.9% and expense of

300.2%, and 37.4%, respectively.

The 2008 income tax rate is greater than the expected U.S. statutory tax rate of 35%

principally due to the non-deductibility of the settlement and related expenses associated with the

Merger-related shareholder lawsuit.

The income tax rate for the Successor period ended February 1, 2008 is a benefit of

26.9%. This benefit is less than the expected U.S. statutory rate of 35% due to the incurrence of

state income taxes in several of the group’ s subsidiaries that file their state income tax returns on