Dollar General 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

the “implied fair value” of goodwill, which would be compared to its corresponding carrying

value.

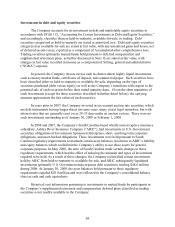

Other assets

Other assets consist primarily of long-term investments, qualifying prepaid expenses,

debt issuance costs which are amortized over the life of the related obligations, and utility and

security deposits. Such debt issuance costs increased substantially subsequent to the Merger as

further discussed in Notes 2 and 6.

Vendor rebates

The Company accounts for all cash consideration received from vendors in accordance

with the provisions of Emerging Issues Task Force Issue (“EITF”) 02-16, “Accounting by a

Customer (Including a Reseller) for Certain Consideration Received from a Vendor.” Cash

consideration received from a vendor is generally presumed to be a rebate or an allowance and is

accounted for as a reduction of merchandise purchase costs and classified as a current or long

term liability, as applicable, until recognition in the statement of operations at the time the goods

are sold. However, certain specific, incremental and otherwise qualifying SG&A expenses

related to the promotion or sale of vendor products may be offset by cash consideration received

from vendors, in accordance with arrangements such as cooperative advertising, when earned for

dollar amounts up to but not exceeding actual incremental costs. The Company recognizes

amounts received for cooperative advertising on performance, “first showing” or distribution,

consistent with its policy for advertising expense in accordance with the American Institute of

Certified Public Accountants Statement of Position 93-7, “Reporting on Advertising Costs.”

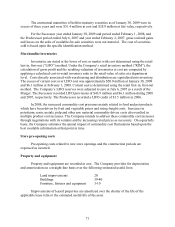

Rent expense

Rent expense is recognized over the term of the lease. The Company records minimum

rental expense on a straight-line basis over the base, non-cancelable lease term commencing on

the date that the Company takes physical possession of the property from the landlord, which

normally includes a period prior to the store opening to make necessary leasehold improvements

and install store fixtures. When a lease contains a predetermined fixed escalation of the

minimum rent, the Company recognizes the related rent expense on a straight-line basis and

records the difference between the recognized rental expense and the amounts payable under the

lease as deferred rent. Tenant allowances, to the extent received, are recorded as deferred

incentive rent and are amortized as a reduction to rent expense over the term of the lease. Any

difference between the calculated expense and the amounts actually paid are reflected as a

liability, with the current portion in Accrued expenses and other and the long-term portion in

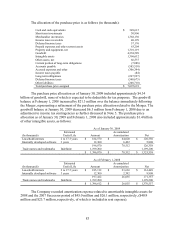

Other liabilities in the consolidated balance sheets, and totaled approximately $7.7 million and

$3.7 million at January 30, 2009 and February 1, 2008, respectively.

The Company recognizes contingent rental expense when the achievement of specified

sales targets are considered probable, in accordance with EITF Issue 98-9, “Accounting for

Contingent Rent.” The amount expensed but not paid as of January 30, 2009 and February 1,