Dollar General 2008 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.153

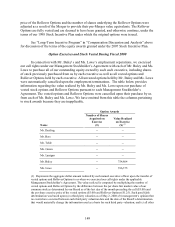

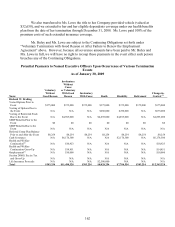

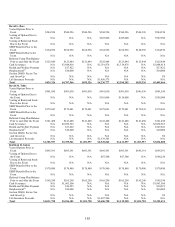

Payments Regardless of Manner of Termination

Regardless of the termination scenario, the named executive officers will receive (and

Mr. Buley and Ms. Lowe received) earned but unpaid base salary through the employment

termination date, along with any other payments or benefits owed under any of our plans or

agreements covering the named executive officer as governed by the terms of those plans or

agreements. These benefits include vested amounts in the CDP/SERP Plan discussed under

“Nonqualified Deferred Compensation” above.

The tables below exclude any amounts payable to the named executive officer to the

extent that they are available generally to all salaried employees and do not discriminate in favor

of our executive officers.

Payments Upon Termination Due to Retirement

Retirement is not treated differently from any other voluntary termination without good

reason (as defined under the relevant agreements) under any of our plans or agreements for

named executive officers, except that all Rollover Options will remain exercisable for a period of

3 years following the named executive officer’ s retirement unless the options expire earlier. To

be entitled to the extended exercise period for the Rollover Options, the retirement must occur on

or after the named executive officer reaches the age of 65 or, with our express consent, prior to

age 65 in accordance with any applicable early retirement policy then in effect or as may be

approved by our Compensation Committee.

Payments Upon Termination Due to Death or Disability

In the event of death or disability, with respect to each named executive officer:

• The 20% portion of the time-based options that would have become exercisable on

the next anniversary date of the Merger if the named executive officer had remained

employed with us through that date will become vested and exercisable.

• The 20% portion of the performance-based options that would have become

exercisable in respect of the fiscal year in which the named executive officer’ s

employment terminates if the named executive officer had remained employed with

us through that date, will remain outstanding through the date we determine whether

the applicable performance targets are met for that fiscal year. If the performance

targets are met for that fiscal year, that 20% portion of the performance-based options

will become exercisable on such performance-vesting determination date. Otherwise,

that 20% portion will be forfeited.

• All unvested options will be forfeited, and vested options generally may be exercised

(by the employee’ s survivor in the case of death) for a period of 1 year (3 years in the

case of Rollover Options) from the service termination date unless we purchase such

vested options in total at the fair market value of the shares of our common stock

underlying the vested options less the aggregate exercise price of the vested options.