Dollar General 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

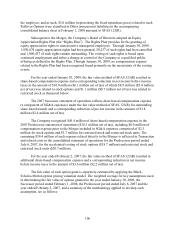

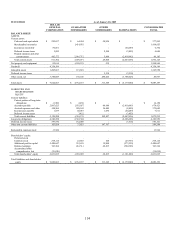

112

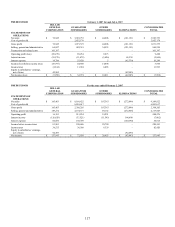

Successor

Predecessor

(In thousands)

2008

March 6, 2007

through

February 1, 2008

February 3, 2007

through

July 6, 2007

2006

Classes of similar products:

Highly consumable

$

7,248,418

$

3,701,724

$

2,615,110

$

6,022,014

Seasonal

1,521,450

908,301

604,935

1,509,999

Home products

862,226

507,027

362,725

914,357

Basic clothing

825,574

454,441

340,983

723,452

Net sales

$

10,457,668

$

5,571,493

$

3,923,753

$

9,169,822

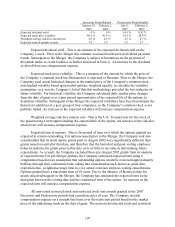

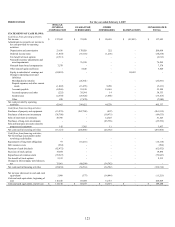

15. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal year ended

January 30, 2009, the Successor period ended February 1, 2008, and the Predecessor period

ended July 6, 2007. Each quarterly period listed below was a 13-week accounting period. The

sum of the four quarters for any given year may not equal annual totals due to rounding.

Successor

(In thousands)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2008:

Net sales

$

2,403,498

$

2,609,384

$

2,598,938

$

2,845,848

Gross profit

693,077

758,035

772,287

837,698

Operating profit

110,871

143,055

103,732

222,828

Net income (loss)

5,916

27,718

(7,306)

81,854

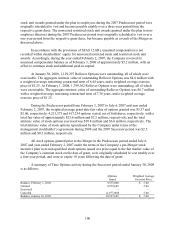

Predecessor

Successor (a)

(In thousands

)

First

Quarter

May 5,

2007

through

July 6,

2007

March 6,

2007

through

August 3,

2007

Third

Quarter

Fourth

Quarter

2007:

Net sales

$

2,275,267

$

1,648,486

$

699,078

$

2,312,842

$

2,559,573

Gross profit

633,060

438,515

184,723

646,800

740,371

Operating profit (loss)

55,368

(46,120)

(6,025)

65,703

186,466

Net income (loss)

34,875

(42,873)

(27,175)

(33,032)

55,389

(a) Includes the results of operations of Buck Acquisition Corp. for the period prior to its Merger with and into

Dollar General Corporation from March 6, 2007 (its formation) through July 6, 2007 (reflecting the change in

fair value of interest rate swaps), and the post-Merger results of Dollar General Corporation for the period from

July 7, 2007 through February 1, 2008. See Notes 1 and 2.

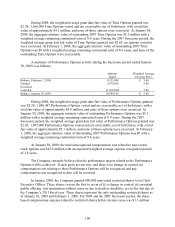

As discussed in Note 1, in the second, third, and fourth quarters of 2008, the Company

recorded LIFO provisions of $16.0 million, $15.7 million, and $12.1 million respectively. These

charges are reflected in Cost of goods sold for each quarter, respectively.

As discussed in Note 8, in the third quarter of 2008, based on the agreement in principle

to settle the Merger-related shareholder litigation, the Company recorded charges of

approximately $34.5 million in connection with the proposed settlement, which was net of

anticipated insurance proceeds of $7.5 million. In the fourth quarter of 2008, the Company

received insurance proceeds totaling $10.0 million, thus reducing the charges to $32.0 million