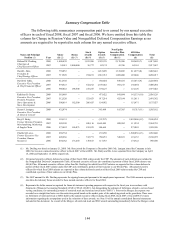

Dollar General 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.141

• We reimburse officers for all reasonable and customary home purchase closing costs

(we limit our reimbursement to other employees to 2% of the purchase price to a

maximum of $2,500) except for loan origination fees which are limited to 1%; and

• We provide 60 days of temporary living expenses (we limit temporary living

expenses to 30 days for all other employees).

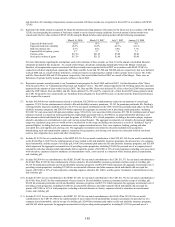

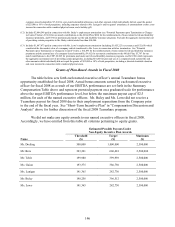

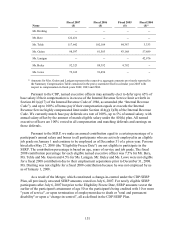

Compensation of Mr. Dreiling

Mr. Dreiling entered into a five-year employment agreement to become CEO and a

member of our Board effective January 21, 2008. Key compensatory provisions of the

agreement include:

• Minimum annual base salary of $1,000,000.

• Annual bonus payout range of 50% (threshold), 100% (target) and up to no less than

200% (maximum) of base salary based upon EBITDA performance. For 2008, Mr.

Dreiling was guaranteed to earn at least a threshold level bonus.

• A signing bonus of $2,000,000.

• Equity grants consisting of 890,000 shares of restricted stock and options to purchase

2.5 million shares of Dollar General at $5 per share (the fair market value on the grant

date). The restricted stock is scheduled to vest upon the earlier to occur of the last day

of fiscal 2011, a change in control, an initial public offering, termination without

cause or due to death or disability, or resignation with good reason. Half of the

options are time-vested and the other half are performance-vested. These options vest

upon the same terms as the other options that have been granted under the 2007 Plan.

• Payment of the premiums on his personal long-term disability insurance policies.

• Use of our plane for Mr. Dreiling and his spouse for up to nine trips per year between

our headquarters and his second home in California.

• Reimbursement and gross-up for taxes of all closing costs and expenses, including

broker’ s fees, loan origination and/or loan discount fees (not to exceed 2 points in

total), and attorney fees incurred to purchase a residence in the Nashville, Tennessee

area and for up to 2 months’ lease cancellation on his apartment in the New York

metropolitan area. Reimbursement and/or payment of and gross-up for taxes of

temporary living expenses for 120 days as well as 2 house hunting trips not to exceed

7 nights/8 days. Relocation also includes the payment of packing, loading,

transporting, storing and delivering his household goods including the movement of 1

car and a miscellaneous expense allowance equal to $50,000 less applicable taxes.

• Reimbursement of legal fees up to $35,000, grossed-up for taxes, incurred in

negotiating and preparing the employment agreement and documents associated with

Mr. Dreiling’ s equity grants.

• Payment of monthly membership fees and costs related to his membership in

professional clubs selected by him, grossed-up for any taxes.

Mr. Dreiling was chosen for the CEO position after a lengthy and careful search. The

Board firmly believes he is the right leader for the Company as we move forward. The terms of

his employment agreement summarized above were settled after negotiation with Mr. Dreiling,