Dollar General 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

The Company adopted SFAS 123(R) effective February 4, 2006 and began recognizing

compensation expense for stock options based on the fair value of the awards on the grant date.

The Company adopted SFAS 123(R) under the modified-prospective-transition method and,

therefore, results from prior periods have not been restated. Under SFAS 123(R), forfeitures are

estimated at the time of valuation and reduce expense ratably over the vesting period.

Prior to the Merger, the Company maintained various share-based compensation

programs which included options, restricted stock and restricted stock units. In connection with

the Merger, the Company’ s outstanding stock options, restricted stock and restricted stock units

became fully vested immediately prior to the closing of the Merger and were settled in cash,

canceled or, in limited circumstances, exchanged for new options of the Company, as described

below. Unless exchanged for new options, each option holder received an amount in cash,

without interest and less applicable withholding taxes, equal to $22.00 less the exercise price of

each in-the-money option. Additionally, each restricted stock and restricted stock unit holder

received $22.00 in cash, without interest and less applicable withholding taxes. Certain stock

options held by Company management were exchanged for new options to purchase common

stock in the Company (the “Rollover Options”). The exercise price of the Rollover Options and

the number of shares of Company common stock underlying the Rollover Options were adjusted

as a result of the Merger. The Rollover Options otherwise continue under the terms of the equity

plan under which the original options were issued.

On July 6, 2007, the Company’ s Board of Directors adopted the 2007 Stock Incentive

Plan for Key Employees, which Plan was subsequently amended (as so amended, the “Plan”).

The Plan provides for the granting of stock options, stock appreciation rights, and other stock-

based awards or dividend equivalent rights to key employees, directors, consultants or other

persons having a service relationship with the Company, its subsidiaries and certain of its

affiliates. The number of shares of Company common stock authorized for grant under the Plan

is 27.5 million, 24 million of which may be granted in the form of stock options. As of January

30, 2009, 4,154,826 of such shares are available for future grants, including 2,913,210 shares

which may be granted in the form of stock options.

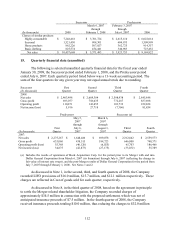

During the 2008 and the 2007 Successor period, the Company granted options that vest

solely upon the continued employment of the recipient (“Time Options”) as well as options that

vest upon the achievement of predetermined annual or cumulative financial-based targets

(“Performance Options”). According to the award terms, 20% of the Time Options and

Performance Options generally vest annually over a five-year period. In the event the

performance target is not achieved in any given period, such options for that period will

subsequently vest upon the achievement of a cumulative performance target. Vesting of the

Time Options and Performance Options is also subject to acceleration in the event of an earlier

change in control or public offering. Each of these options, whether Time Options or

Performance Options have a contractual term of 10 years and an exercise price equal to the fair

value of the stock on the date of grant.

Both the Time Options and the Performance Options are subject to various provisions set

forth in a management stockholder’ s agreement entered into with each option holder by which

the Company may require the employee, upon termination, to sell to the Company any vested