Dollar General 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

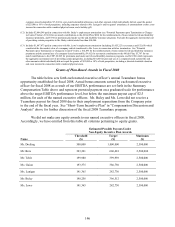

145

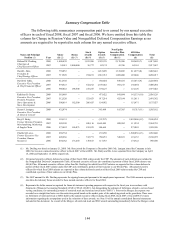

and, therefore, all remaining compensation expense associated with those awards was recognized in fiscal 2007 in accordance with SFAS

123(R).

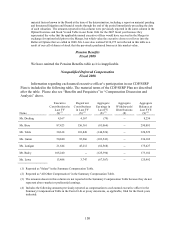

(5) Represents the dollar amount recognized for financial statement reporting purposes with respect to the fiscal year in accordance with SFAS

123(R), but disregarding the estimate of forfeitures related to service-based vesting conditions, for stock options. Option awards were

valued under the fair value method of SFAS 123(R) using the Black-Scholes option pricing model with the following assumptions:

March 16, 2006

March 23, 2007

July 7, 2007

January 21, 2008

Expected dividend yield

.82%

.91%

0%

0%

Expected stock price volatility

28.7%

18.5%

42.3%

41.1%

Risk-free interest rate

4.7%

4.5%

4.9%

3.7%

Expected life of options (years)

5.7

5.7

7.5

7.3

Exercise price

$17.54

$21.25

$5.00

$5.00

Stock price on date of grant

$17.54

$21.25

$5.00

$5.00

For more information regarding the assumptions used in the valuation of these awards, see Note 10 of the annual consolidated financial

statements included in this document. As a result of the Merger, all options outstanding immediately before the Merger vested and,

therefore, all compensation expense associated with those awards was recognized in fiscal 2007 in accordance with SFAS 123(R). In

connection with their employment separations, Mr. Buley and Ms. Lowe had 787,500 and 540,000 options, respectively, that were forfeited

in fiscal 2008 and, as a result of those forfeitures, certain previously recorded expenses related to these options were reversed. Mr. Tehle

and Ms. Guion had 63,000 and 50,300 options, respectively, that were forfeited in fiscal 2007 as a result of the Merger. There were no

forfeitures of options held by named executive officers in fiscal 2006.

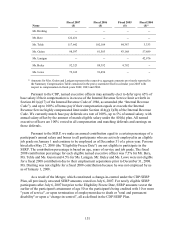

(6) Represents amounts earned pursuant to our Teamshare bonus program for fiscal 2008 and fiscal 2007. See the discussion of the “Short-

Term Incentive Plan” in “Compensation Discussion and Analysis” above. The 2007 amount reported for Mr. Dreiling represents a prorated

payment for the number of days worked in fiscal 2007. Mr. Bere and Ms. Guion each deferred 5% of his or her fiscal 2008 bonus payments

under the CDP. Messrs. Bere and Buley and Ms. Guion deferred 5%, 20% and 5%, respectively, of their fiscal 2007 bonus payments under

the CDP. No amounts were earned under our Teamshare bonus program for fiscal 2006 because we did not meet the financial performance

level required for a payout.

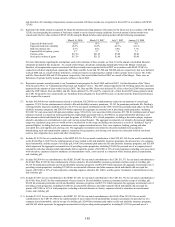

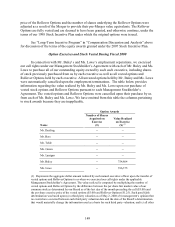

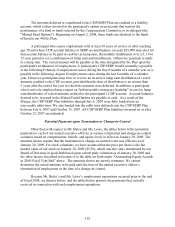

(7) Includes $45,840 for tax reimbursements related to relocation, $26,200 for tax reimbursements related to our payment of certain legal

expenses, $7,832 for tax reimbursements related to life and disability insurance premiums, $5,183 for premiums paid under Mr. Dreiling’ s

existing portable long-term disability policies, $4,167 for our match contributions to the CDP, $3,824 for premiums paid under our life and

disability insurance programs, and $249,599 which represents the aggregate incremental cost of providing certain perquisites, including

$114,647 for costs associated with personal airplane usage, $76,641 for costs associated with relocation, $33,706 for reimbursement of legal

expenses incurred in connection with negotiating his employment agreement with us, $21,000 for an annual automobile allowance, and

other amounts which individually did not equal the greater of $25,000 or 10% of total perquisites, including a decorative plaque, expenses

related to attendance at entertainment events, and a racing scanner/headset. The aggregate incremental cost related to the personal airplane

usage was calculated using costs we would not have incurred but for the usage (including costs incurred as a result of “deadhead” legs of

personal flights), including fuel costs, maintenance costs, engine restoration/reserve fees, crew expenses, landing, parking and other

associated fees, and supplies and catering costs. The aggregate incremental cost related to relocation included moving expenses,

househunting meal and transportation expenses, temporary living expenses, and closing costs incurred in connection with his new home

(such as loan origination fees, points and other closing fees).

(8) Includes $130,999 for our contributions to the SERP, $25,363 for our match contributions to the CDP, $11,586 for our match contributions

to the 401(k) Plan, $13,407 for the reimbursement of taxes related to life and disability insurance premiums, the personal use of a company-

leased automobile, and the receipt of a holiday gift, $4,081 for premiums paid under our life and disability insurance programs, and $25,839

which represents the aggregate incremental cost of providing certain perquisites, including $18,698 for personal use of a company-leased

automobile and other amounts which individually did not equal the greater of $25,000 or 10% of total perquisites, including costs associated

with relocation, expenses related to attendance at entertainment events, costs incurred in connection with a medical physical examination,

and a holiday gift.

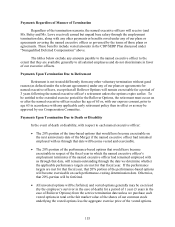

(9) Includes $82,806 for our contributions to the SERP, $19,043 for our match contributions to the CDP, $11,571 for our match contributions to

the 401(k) Plan, $3,829 for the reimbursement of taxes related to life and disability insurance premiums and the receipt of a holiday gift,

$3,325 for premiums paid under our life and disability insurance programs, and $32,858 which represents the aggregate incremental cost of

providing certain perquisites, including $21,000 for an automobile allowance and other amounts which individually did not equal the

greater of $25,000 or 10% of total perquisites, including expenses related to Mr. Tehle’ s and his guests’ attendance at entertainment events,

and a holiday gift.

(10) Includes $75,015 for our contributions to the SERP, $17,251 for our match contributions to the CDP, $11,792 for our match contributions to

the 401(k) Plan, $6,052 for the reimbursement of taxes related to life and disability insurance premiums and the receipt of a holiday gift,

$3,860 for premiums paid under our life and disability insurance programs, and $27,363 which represents the aggregate incremental cost of

providing certain perquisites, including $21,000 for an automobile allowance and other amounts which individually did not equal the

greater of $25,000 or 10% of total perquisites, including a directed donation to charity, expenses related to attendance at entertainment

events, and a holiday gift.

(11) Includes $35,121 for our contributions to the SERP, $11,550 for our match contributions to the 401(k) Plan, $10,091 for our match

contributions to the CDP, $9,150 for the reimbursement of taxes related to life and disability insurance premiums, the personal use of a

company-leased automobile, and the receipt of a holiday gift, $2,494 for premiums paid under our life and disability insurance programs,

and $24,909 which represents the aggregate incremental cost of providing certain perquisites, including $12,128 for personal use of a