Dollar General 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

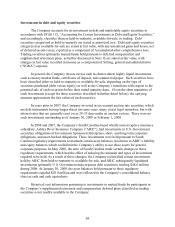

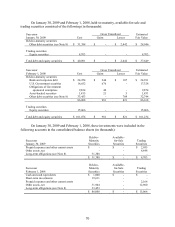

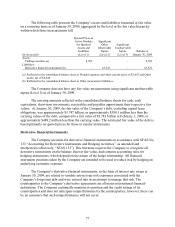

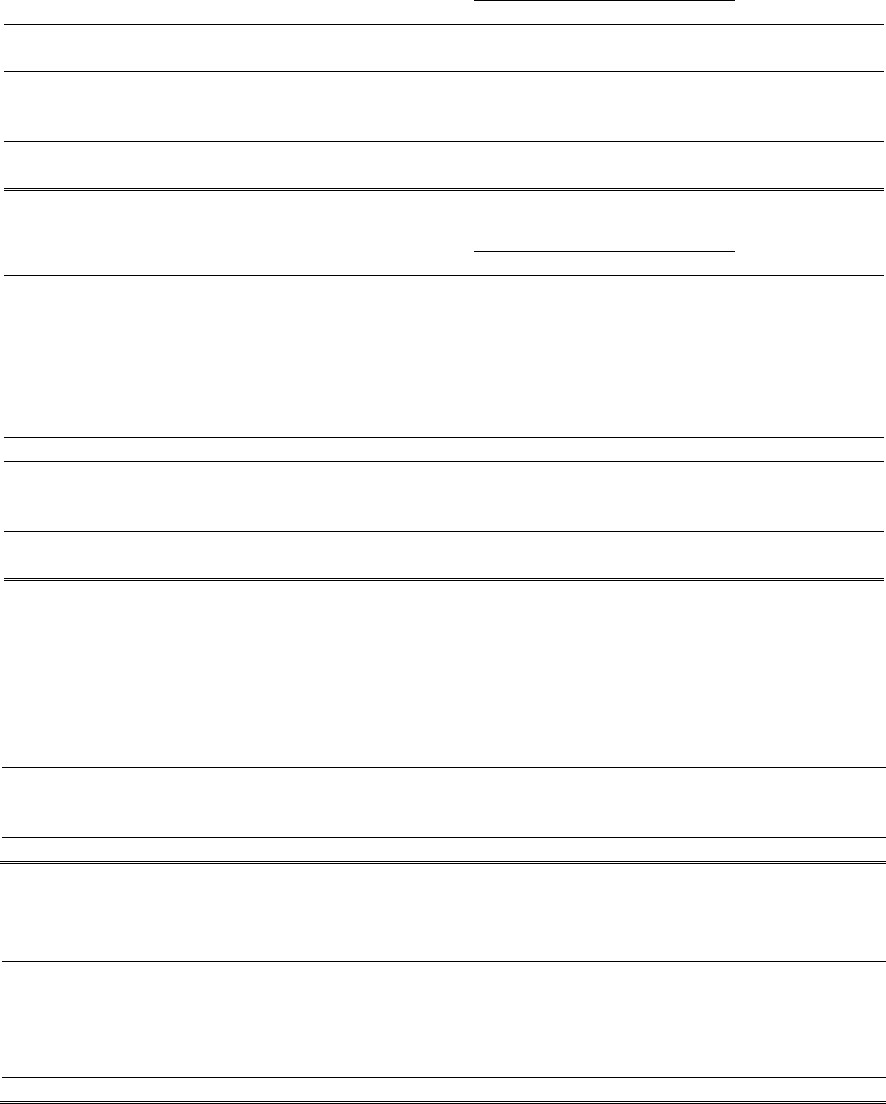

On January 30, 2009 and February 1, 2008, held-to-maturity, available-for-sale and

trading securities consisted of the following (in thousands):

Successor

January 30, 2009

Cost

Gross Unrealized

Estimated

Fair Value

Gains

Losses

Held-to-maturity securities

Other debt securities (see Note 8)

$

31,388

$

-

$

2,442

$

28,946

Trading securities

Equity securities

8,703

-

-

8,703

Total debt and equity securities

$

40,091

$

-

$

2,442

$

37,649

Successor

February 1, 2008

Cost

Gross Unrealized

Estimated

Fair Value

Gains

Losses

Held-to-maturity securities

Bank and corporate debt

$

24,254

$

244

$

107

$

24,391

U.S. Government securities

16,652

676

-

17,328

Obligations of Government

sponsored enterprises

9,834

40

-

9,874

Asset-backed securities

1,815

21

5

1,831

Other debt securities (see Note 8)

33,453

-

709

32,744

86,008

981

821

86,168

Trading securities

Equity securities

15,066

-

-

15,066

Total debt and equity securities

$

101,074

$

981

$

821

$

101,234

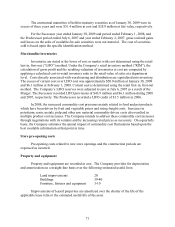

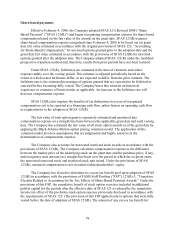

On January 30, 2009 and February 1, 2008, these investments were included in the

following accounts in the consolidated balance sheets (in thousands):

Successor

January 30, 2009

Held-to-

Maturity

Securities

Available-

for-Sale

Securities

Trading

Securities

Prepaid expenses and other current assets

$

-

$

-

$

2,055

Other assets, net

-

-

6,648

Long-term obligations (see Note 8)

31,388

-

-

$

31,388

$

-

$

8,703

Successor

February 1, 2008

Held-to-

Maturity

Securities

Available-

for-Sale

Securities

Trading

Securities

Cash and cash equivalents

$

1,000

$

-

$

-

Short-term investments

19,611

-

-

Prepaid expenses and other current assets

-

-

2,166

Other assets, net

31,944

-

12,900

Long-term obligations (see Note 8)

33,453

-

-

$

86,008

$

-

$

15,066