Dollar General 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.161

us, KKR and its affiliates or an employee benefit plan referenced below ceasing to hold the

ability to elect (or cause to be elected) a majority of our Board members:

• the sale of all or substantially all of the assets of Buck Holdings, L.P. or us and our

subsidiaries to any person (or group of persons acting in concert), other than to (x)

investment funds affiliated with KKR or its affiliates or (y) any employee benefit plan

(or trust forming a part thereof) maintained by us, KKR or our respective affiliates or

other person of which a majority of its voting power or other equity securities is

owned, directly or indirectly, by us, KKR or our respective affiliates; or

• a merger, recapitalization or other sale by us, KKR (indirectly) or any of our

respective affiliates, to a person (or group of persons acting in concert) of our

common stock or our other voting securities that results in more than 50% of our

common stock or our other voting securities (or any resulting company after a

merger) being held, directly or indirectly, by a person (or group of persons acting in

concert) that is not controlled by (x) KKR or its affiliates or (y) an employee benefit

plan (or trust forming a part thereof) maintained us, KKR or our respective affiliates

or other person of which a majority of its voting power or other equity securities is

owned, directly or indirectly, by us, KKR or our respective affiliates.

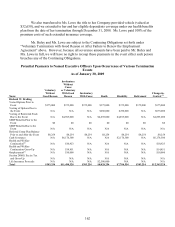

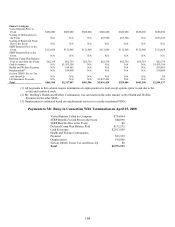

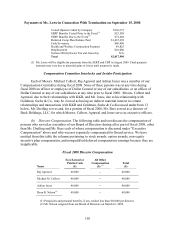

Payments to Mr. Buley and Ms. Lowe

Mr. Buley’ s and Ms. Lowe’ s employment with us ended in April 2008 and September

2008, respectively. Mr. Buley and Ms. Lowe each received the following payments and benefits

under their respective employment agreements and other plans in which he or she participated.

The severance payments were contingent upon execution and effectiveness of a release of certain

claims against us and our affiliates in the form attached to the relevant employment agreement.

• A lump sum payment equal to the sum of (x) 2 times the sum of his or her annual

base salary as in effect at the relevant employment termination date, plus (y) 2 times

his or her target incentive bonus for fiscal 2008, plus (z) 2 times our annual

contribution for his or her participation in our medical, dental and vision benefits

program.

• In lieu of providing Mr. Buley and Ms. Lowe the third party outplacement services

described above, we paid a cash amount to each equal to the estimated amount we

would have incurred to provide such services.

• All unvested equity grants automatically terminated.

• We exercised our call rights under our Management Stockholder’ s Agreement with

each of Mr. Buley and Ms. Lowe to purchase all of our outstanding equity owned by

each such executive, including shares of stock previously purchased from us by Ms.

Lowe, as well as all vested options and vested Rollover Options held by each

executive. See “Option Exercises and Stock Vested during Fiscal 2008” above.