Dollar General 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

a separate entity basis and the election to include, effective February 3, 2007, income tax related

interest and penalties in the amount reported as income tax expense.

The income tax rate for the Predecessor period ended July 6, 2007 is an expense of

300.2%. This expense is higher than the expected U.S. statutory rate of 35% due principally to

the non-deductibility of certain acquisition related expenses.

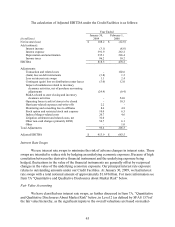

Unaudited Pro Forma Condensed Consolidated Financial Information

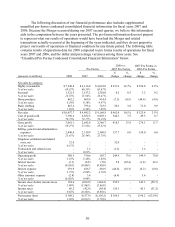

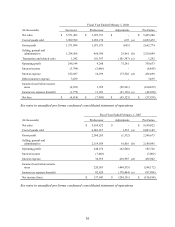

The following supplemental unaudited pro forma condensed consolidated statement of

operations data has been developed by applying pro forma adjustments to our historical

consolidated statement of operations. We were acquired on July 6, 2007 through a merger

accounted for as a reverse acquisition. Although we continued as the same legal entity after the

Merger, the accompanying unaudited pro forma condensed consolidated financial information is

presented for the Predecessor and Successor relating to the periods preceding and succeeding the

Merger, respectively. As a result of the Merger, we applied purchase accounting standards and a

new basis of accounting effective July 7, 2007. The unaudited pro forma condensed consolidated

statements of operations for the years ended February 1, 2008 and February 2, 2007 gives effect

to the Merger as if it had occurred on February 3, 2007 and February 4, 2006, respectively.

Assumptions underlying the pro forma adjustments are described in the accompanying notes,

which should be read in conjunction with this unaudited pro forma condensed consolidated

financial statement.

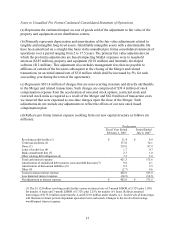

The unaudited pro forma adjustments are based upon available information and certain

assumptions that we believe are reasonable under the circumstances. The unaudited pro forma

condensed consolidated financial information is presented for supplemental informational

purposes only, although we believe this information is useful in providing comparisons between

years. The unaudited pro forma condensed consolidated financial information does not purport to

represent what our results of operations would have been had the Merger and related transactions

actually occurred on the date indicated, and they do not purport to project our results of

operations or financial condition for any future period. The unaudited pro forma condensed

consolidated statements of operations should be read in conjunction with the information

contained in other sections of this 2008 Form 10-K including “Selected Financial Data”, in our

consolidated financial statements and related notes thereto, and other sections of this

Management's Discussion and Analysis of Financial Condition and Results of Operations”

appearing elsewhere in this fiscal 2008 Form 10-K. All pro forma adjustments and their

underlying assumptions are described more fully in the notes to our unaudited pro forma

condensed consolidated statements of operations.