Dollar General 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

general corporate purposes, as further described above under “Investments in debt and equity

securities.” ARIC currently insures no unrelated third-party risk.

As a result of the Merger, the Company recorded its assumed self-insurance reserves as

of the Merger date at their present value in accordance with SFAS 141, “Business

Combinations”, using a discount rate of 5.4%. The balance of the resulting discount was $11.7

million and $18.7 million at January 30, 2009 and February 1, 2008, respectively. Other than for

reserves assumed in a business combination, the Company’ s policy is to record self-insurance

reserves on an undiscounted basis.

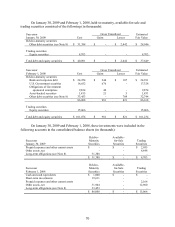

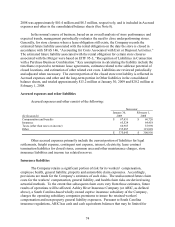

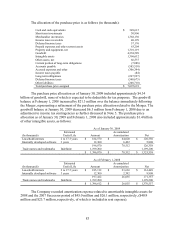

Other liabilities

Other non-current liabilities consist of the following:

Successor

(In thousands)

January 30,

2009

February 1,

2008

Compensation and benefits

$

8,399

$

13,744

Insurance

139,410

123,276

Income tax related reserves

44,990

78,277

Derivatives

63,523

82,319

Other

32,966

22,098

$

289,288

$

319,714

Other liabilities consist primarily of deferred rent, lease contract termination liabilities for

closed stores, leasehold interests liabilities, and rebate obligations.

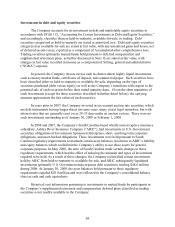

Fair value accounting

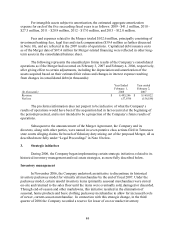

On February 2, 2008, the Company adopted components of SFAS No. 157, “Fair Value

Measurements”. The Company has not adopted SFAS 157 for nonfinancial assets and liabilities.

SFAS 157 defines fair value, establishes a framework for measuring fair value, and expands

disclosures about fair value measurements. SFAS 157 applies to reported balances that are

required or permitted to be measured at fair value under existing accounting pronouncements.

Accordingly, the standard does not require any new fair value measurements of reported

balances.

SFAS 157 emphasizes that fair value is a market-based measurement, not an entity-

specific measurement. Therefore, a fair value measurement should be determined based on the

assumptions that market participants would use in pricing the asset or liability. As a basis for

considering market participant assumptions in fair value measurements, SFAS 157 establishes a

fair value hierarchy that distinguishes between market participant assumptions based on market

data obtained from sources independent of the reporting entity (observable inputs that are

classified within Levels 1 and 2 of the hierarchy) and the reporting entity’ s own assumptions

about market participant assumptions (unobservable inputs classified within Level 3 of the

hierarchy).