Dollar General 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

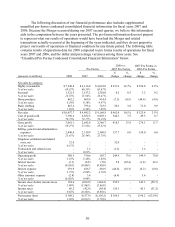

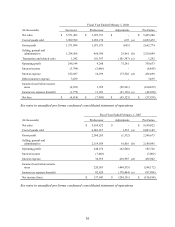

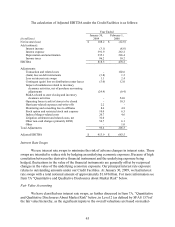

(2) Reflects interest on the $2.3 billion term loan facility at a rate of LIBOR plus 2.75%. To hedge against

interest rate risk, we have entered into a swap agreement with respect to a $2.0 billion notional amount for

4.93%. This swap agreement became effective as a result of the acquisition on July 31, 2007 and will amortize

on a quarterly basis until maturity at July 31, 2012. The unhedged portion of the facility is reflected at an

interest rate of LIBOR of 5.32% plus 2.75%.

(3) Reflects interest on the 10.625% senior notes and 11.875%/12.625% senior subordinated notes. Assumes the

cash interest payment option at a rate of 11.875% has been elected with respect to all of the senior subordinated

notes.

(4) Represents fees on balances of trade letters of credit of $141.2 million at 0.75% and standby letters of credit

of $40.7 million at 1.50%.

(5) Represents commitment fees of 0.375% on the $612.1 million unutilized balance of the revolving credit

facility at July 6, 2007. Outstanding letters of credit noted in (4) above reduce the availability under the

revolving credit facility.

(6) Represents historical interest expense on other existing indebtedness.

(7) Represents debt issuance costs associated with the new bank facilities amortized using the effective interest

method over 6 years for the revolving facility, 7 years for the term loan facility, 8 years for the senior notes, 10

years for the senior subordinated notes and 8 years for other capitalized debt issuance costs. Also includes the

amortization of debt discount of the senior notes.

(8) Represents interest expense on long-term liabilities which were discounted as a result of the Merger.

(9) Represents an adjustment to historical interest expense to reflect the effect of the adoption of current

accounting standards for income taxes, offset by capitalized interest expense.

(e) Represents the tax effect of the pro forma adjustments, calculated at an effective rate of

54.1% for the Predecessor period ended July 6, 2007 and 36.7% for the fiscal year ended

February 2, 2007. The effective tax rate, a benefit, applied to the pro forma changes for the

Predecessor period ended July 6, 2007, reflects the pro forma elimination of non-deductible

transaction costs from income before taxes. The pro forma income tax expense for the year

ended February 2, 2007 has been adjusted to reflect changes required by FIN 48 as if FIN 48 had

been adopted as of the beginning of the year.

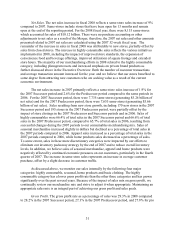

Effects of Inflation

In 2008, increased commodity cost pressures mainly related to food and pet products

which have been driven by fruit and vegetable prices and rising freight costs have increased the

costs of certain products. Increases in petroleum, resin, metals, pulp and other raw material

commodity driven costs also resulted in multiple product cost increases. We believe that our

ability to increase selling prices in response to cost increases largely mitigated the effect of these

cost increases on our overall results of operations. We believe that inflation and/or deflation had

a minimal impact on our overall operations during 2007 and 2006.

Liquidity and Capital Resources

Current Financial Condition / Recent Developments. During the past three years, we

have generated an aggregate of approximately $1.4 billion in cash flows from operating