Dollar General 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

stock unit awards granted under the plan to employees during the 2007 Predecessor period were

originally scheduled to vest and become payable ratably over a three-year period from the

respective grant dates. The nonvested restricted stock unit awards granted under the plan to non-

employee directors during the 2007 Predecessor period were originally scheduled to vest over a

one-year period from the respective grant dates, but became payable as a result of the Merger as

discussed above.

In accordance with the provisions of SFAS 123(R), unearned compensation is not

recorded within shareholders’ equity for nonvested restricted stock and restricted stock unit

awards. Accordingly, during the year ended February 2, 2007, the Company reversed its

unearned compensation balance as of February 3, 2006 of approximately $5.2 million, with an

offset to common stock and additional paid-in capital.

At January 30, 2009, 1,129,297 Rollover Options were outstanding, all of which were

exercisable. The aggregate intrinsic value of outstanding Rollover Options was $4.8 million with

a weighted average remaining contractual term of 6.44 years, and a weighted average exercise

price of $1.25. At February 1, 2008, 1,799,102 Rollover Options were outstanding, all of which

were exercisable. The aggregate intrinsic value of outstanding Rollover Options was $6.7 million

with a weighted average remaining contractual term of 7.36 years, and a weighted average

exercise price of $1.25.

During the Predecessor period from February 3, 2007 to July 6, 2007 and year ended

February 2, 2007, the weighted average grant date fair value of options granted was $5.37 and

$5.86, respectively; 4,213,373 and 617,234 options vested, net of forfeitures, respectively; with a

total fair value of approximately $23.6 million and $2.5 million, respectively; and the total

intrinsic value of stock options exercised was $10.8 million and $6.8 million, respectively. The

total intrinsic value of stock options repurchased by the Company under terms of the

management stockholder’ s agreements during 2008 and the 2007 Successor period was $2.5

million and $0.5 million, respectively.

All stock options granted prior to the Merger in the Predecessor period ended July 6,

2007 and year ended February 2, 2007 under the terms of the Company’ s pre-Merger stock

incentive plan were non-qualified stock options issued at a price equal to the fair market value of

the Company’ s common stock on the date of grant, were originally scheduled to vest ratably over

a four-year period, and were to expire 10 years following the date of grant.

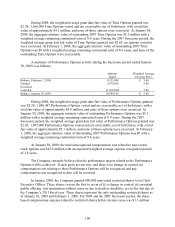

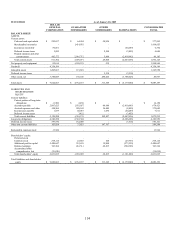

A summary of Time Options activity during the Successor period ended January 30, 2009

is as follows:

Options

Issued

Weighted Average

Exercise Price

Balance, February 1, 2008

9,535,000

$

5.00

Granted

2,979,645

5.00

Exercised

-

-

Canceled

(1,977,000)

5.00

Balance, January 30, 2009

10,537,645

$

5.00