Dollar General 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

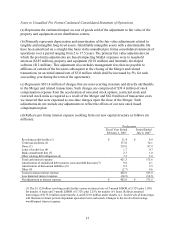

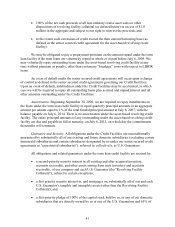

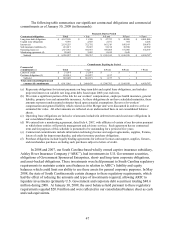

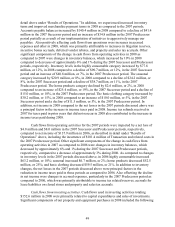

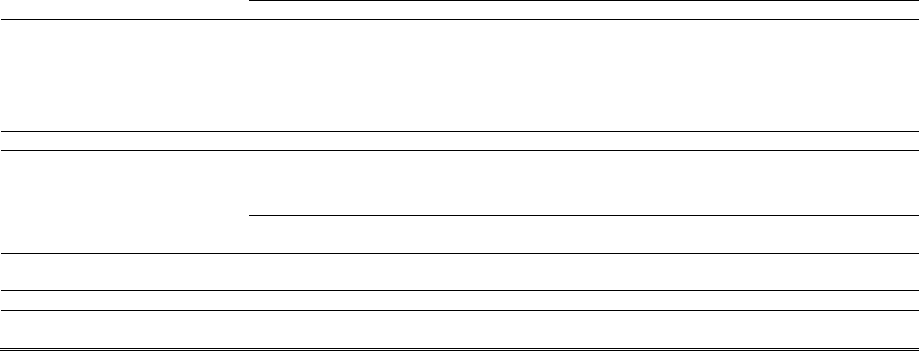

The following table summarizes our significant contractual obligations and commercial

commitments as of January 30, 2009 (in thousands):

Payments Due by Period

Contractual obligations

Total

< 1 yr

1-3 yrs

3-5 yrs

> 5 yrs

Long-term debt obligations

$

4,147,109

$

11,500

$

47,723

$

46,000

$

4,041,886

Capital lease obligations

9,939

2,658

2,471

564

4,246

Interest (a) 2,159,555

332,792

661,518

656,169

509,076

Self-insurance liabilities (b)

216,817

70,047

93,198

30,590

22,982

Operating leases (c)

1,671,935

358,367

569,005

371,966

372,597

Monitoring agreement (d)

20,682

5,403

11,630

3,649

-

Subtotal

$

8,226,037

$

780,767

$

1,385,545

$

1,108,938

$

4,950,787

Commitments Expiring by Period

Commercial

commitments (e)

Total

< 1 yr

1-3 yrs

3-5 yrs

> 5 yrs

Letters of credit

$

51,014

$

51,014

$

-

$

-

$

-

Purchase obligations (f)

634,014

632,857

1,157

-

-

Subtotal

$

685,028

$

683,871

$

1,157

$

-

$

-

Total contractual obligations and

commercial commitments $ 8,911,065

$ 1,464,638

$ 1,386,702

$ 1,108,938

$ 4,950,787

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and includes

projected interest on variable rate long-term debt, based upon 2008 year end rates.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health insurance, general

liability, property loss and automobile insurance. As these obligations do not have scheduled maturities, these

amounts represent undiscounted estimates based upon actuarial assumptions. Reserves for workers’

compensation and general liability which existed as of the Merger date were discounted in order to arrive at

estimated fair value. All other amounts are reflected on an undiscounted basis in our consolidated balance

sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent and closed store obligations in

our consolidated balance sheets.

(d) We entered into a monitoring agreement, dated July 6, 2007, with affiliates of certain of our Investors pursuant

to which those entities will provide management and advisory services. Such agreement has no contractual

term and for purposes of this schedule is presumed to be outstanding for a period of five years.

(e) Commercial commitments include information technology license and support agreements, supplies, fixtures,

letters of credit for import merchandise, and other inventory purchase obligations.

(f) Purchase obligations include legally binding agreements for software licenses and support, supplies, fixtures,

and merchandise purchases excluding such purchases subject to letters of credit.

In 2008 and 2007, our South Carolina-based wholly owned captive insurance subsidiary,

Ashley River Insurance Company (“ARIC”), had investments in U.S. Government securities,

obligations of Government Sponsored Enterprises, short- and long-term corporate obligations,

and asset-backed obligations. These investments were held pursuant to South Carolina regulatory

requirements to maintain certain asset balances in relation to ARIC’ s liability and equity

balances which could limit our ability to use these assets for general corporate purposes. In May

2008, the state of South Carolina made certain changes to these regulatory requirements, which

had the effect of reducing the amounts and types of investments required, allowing ARIC to

liquidate investments (primarily U.S. Government and corporate debt securities) totaling $48.6

million during 2008. At January 30, 2009, the asset balances held pursuant to these regulatory

requirements equaled $20.0 million and were reflected in our consolidated balance sheet as cash

and cash equivalents.