Dollar General 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

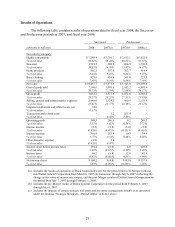

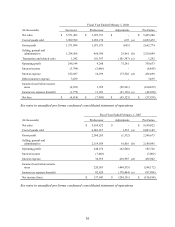

SG&A decreased to 23.4% in 2008 compared to 24.3% in pro forma 2007. The more

significant items resulting in the decrease from the 2007 pro forma results include: $54.0 million

of costs in pro forma 2007 SG&A relating to the closing of stores and the elimination of our

packaway inventory strategy; a $12.0 million loss in the 2007 pro forma period compared to a

$5.0 million gain in 2008 relating to possible losses on distribution center leases; and decreases

in workers compensation and other insurance-related costs in 2008 of $10.4 million compared to

the 2007 pro forma period. These decreases were partially offset by an increase in incentive

compensation and related payroll taxes of $42.0 million in 2008 compared to pro forma 2007 due

to improved overall financial performance and an increase in professional fees in 2008 of $10.4

million compared to pro forma 2007 primarily reflecting legal expenses related to shareholder

litigation.

SG&A expense increased as a percentage of sales to 23.8% in the 2007 Successor period

and 24.5% in the 2007 Predecessor period from 23.1% in 2006. SG&A in the 2007 periods

includes: $23.4 million in the 2007 Successor period related to amortization of leasehold

intangibles capitalized in connection with the revaluation of assets at the date of the Merger;

$19.3 million and $7.6 million of administrative employee incentive compensation expense in

the 2007 Successor and Predecessor periods, respectively, resulting from meeting certain

financial targets (compared to $9.6 million of discretionary bonuses in 2006); approximately

$9.0 million and $45.0 million of expenses in the 2007 Successor and Predecessor periods,

respectively, relating to the closing of stores and the elimination of our packaway inventory

strategy (compared to approximately $33 million in 2006) and an accrued loss of approximately

$12.0 million in the 2007 Successor period relating to probable losses for certain distribution

center leases. In addition, SG&A in the 2007 Successor period includes approximately $4.8

million of KKR-related consulting and monitoring fees. SG&A expense in 2006 was partially

offset by insurance proceeds of $13.0 million received during the year related to losses incurred

due to Hurricane Katrina.

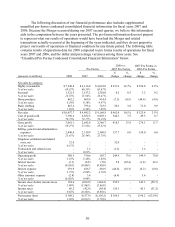

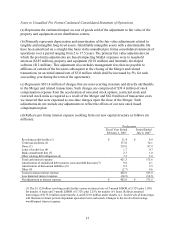

On a pro forma basis, SG&A expense increased as a percentage of sales to 24.3% in 2007

compared to 23.8% in 2006. Pro forma SG&A includes: $26.9 million of administrative

employee incentive compensation expense in 2007 resulting from meeting certain financial

targets, compared to $9.6 million of discretionary bonuses in 2006; approximately $54 million of

expenses in 2007 relating to the closing of stores and the elimination of our packaway inventory

strategy, compared to approximately $33 million in 2006; and an accrued loss of approximately

$12.0 million in 2007 relating to probable losses for certain distribution center leases. SG&A

expense in 2006 was partially offset by insurance proceeds of $13.0 million received during the

year related to losses incurred due to Hurricane Katrina.

Litigation Settlement and Related Costs, Net. The $32.0 million in 2008 represents the

settlement of a class action lawsuit filed in response to the Merger, and includes a $40.0 million

settlement and estimated expenses of $2.0 million, net of $10.0 million of insurance proceeds

received in the fourth quarter of 2008.

Transaction and Related Costs. The $1.2 million and $101.4 million of expenses

recorded in the 2007 Successor and Predecessor periods reflect $1.2 million and $62.0 million,

respectively, of expenses related to the Merger, such as investment banking and legal fees as