Dollar General 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

Successor period presented. Additionally, because the Company received the requisite consents

to the proposed amendments to the indenture pursuant to which the 2010 Notes were issued, a

supplemental indenture to effect such amendments was executed and delivered. The

amendments, which eliminated substantially all of the restrictive covenants contained in the

indenture, became operative upon the purchase of the tendered 2010 Notes.

7. Derivative financial instruments

The Company uses interest rate swaps to manage its interest rate risk. In April 2007,

Buck entered into interest rate swaps, contingent upon the completion of the Merger, on a

portion of the loans anticipated to result from the Merger. These swaps were designated as cash

flow hedges on October 12, 2007. As a result of these swaps, the Company is paying an all-in

fixed interest rate of 7.68% on a notional amount equal to $866.7 million as of January 30, 2009.

The notional amount of these swaps amortizes on a quarterly basis through July 31, 2012.

Unrealized losses of $3.7 million for the 2007 Successor period are included in Other (income)

expense in the consolidated statements of operations, reflecting the changes in fair value of these

swaps prior to their designation as qualifying cash flow hedging relationships in October 2007,

which were offset by earnings under the contractual provisions of the swaps of $1.7 million

during the same time period.

In October 2008 the Company terminated one of the interest rate swaps entered into by

Buck in April 2007 with a notional amount equal to $486.7 million as of the date of termination.

The termination was the result of the bankruptcy declaration by the counterparty to the swap and

this technical default gave the Company the right to terminate the derivative contract. The

Company subsequently cash settled the swap in November 2008 for approximately $7.6 million,

including interest accrued to the date of termination.

The estimated fair value of the Company’ s terminated interest rate swap was a liability of

approximately $5.0 million as of October 30, 2008 (the termination date). Based on various

factors, the Company concluded that the hedge was expected to be highly effective at achieving

offsetting cash flows attributable to the hedged risk, and has therefore applied hedge accounting

for this interest rate swap through the termination date.

Upon termination, the Company performed the final effectiveness test, and the amount

related to the gains and losses since the hedge designation date of approximately $3.7 million

(after adjusting for the termination) remained in Accumulated other comprehensive loss at the

termination date. Such amount is being reclassified into earnings as interest expense over the

term of the original swap as the hedged forecasted transactions impact earnings and this expense

is expected to be approximately $1.4 million in 2009.

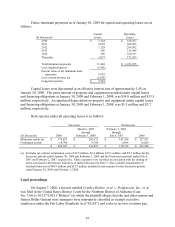

In February and December 2008, the Company entered into additional interest rate swaps,

each of which were designated as cash flow hedges at inception. At January 30, 2009, the

Company is paying all-in fixed interest rates of 5.58% and 5.06% on notional amounts of $350.0

million and $475.0 million, respectively, pursuant to the February 2008 and December 2008

swaps. The notional amount of the February 2008 swap reduces to $150.0 million in February