Dollar General 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

price of the Rollover Options and the number of shares underlying the Rollover Options were

adjusted as a result of the Merger to provide their pre-Merger value equivalents. The Rollover

Options are fully vested and are deemed to have been granted, and otherwise continue, under the

terms of our 1998 Stock Incentive Plan under which the original options were issued.

See “Long-Term Incentive Program” in “Compensation Discussion and Analysis” above

for discussion of the terms of the equity awards granted under the 2007 Stock Incentive Plan.

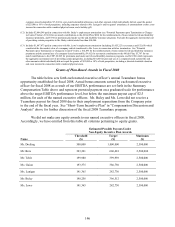

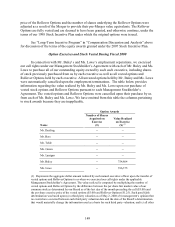

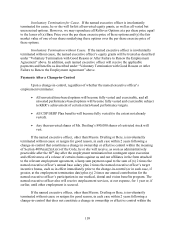

Option Exercises and Stock Vested During Fiscal 2008

In connection with Mr. Buley’ s and Ms. Lowe’ s employment separations, we exercised

our call rights under our Management Stockholder’ s Agreement with each of Mr. Buley and Ms.

Lowe to purchase all of our outstanding equity owned by each such executive, including shares

of stock previously purchased from us by each executive as well as all vested options and

Rollover Options held by each executive. All unvested options held by Mr. Buley and Ms. Lowe

were automatically cancelled upon the employment terminations. The table below provides

information regarding the value realized by Mr. Buley and Ms. Lowe upon our purchase of

vested stock options and Rollover Options pursuant to each Management Stockholder’ s

Agreement. The vested options and Rollover Options were cancelled upon their purchase by us

from each of Mr. Buley and Ms. Lowe. We have omitted from this table the columns pertaining

to stock awards because they are inapplicable.

Option Awards

Name

Number of Shares

Acquired on

Exercise

(#)

Value Realized

on Exercise

($) (1)

Mr. Dreiling -- --

Mr. Bere -- --

Mr. Tehle -- --

Ms. Guion -- --

Ms. Lanigan -- --

Mr. Buley -- 754,864

Ms. Lowe -- 396,375

(1) Represents the aggregate dollar amount realized by each named executive officer upon the transfer of

vested options and Rollover Options to us when we exercised our call rights under the applicable

Management Stockholder’ s Agreement. The value realized is computed by multiplying the number of

vested options and Rollover Options by the difference between the per share fair market value of our

common stock as determined by our Board as of the last day of the month preceding the call ($5.00) and

the per share exercise price of the vested options ($5.00) and Rollover Options ($1.25). Such good faith

determination was based upon (a) a third party valuation as of May 2, 2008; (b) management’ s opinion that

no events have occurred between such third party valuation date and the date of the Board’ s determination

that would materially change the information used as a basis for such third party valuation; and (c) all other