Dollar General 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

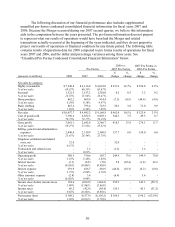

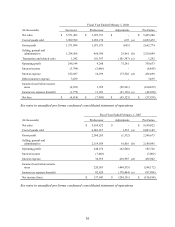

Notes to Unaudited Pro Forma Condensed Consolidated Statement of Operations

(a) Represents the estimated impact on cost of goods sold of the adjustment to fair value of the

property and equipment at our distribution centers.

(b) Primarily represents depreciation and amortization of the fair value adjustments related to

tangible and intangible long-lived assets. Identifiable intangible assets with a determinable life

have been amortized on a straight-line basis in the unaudited pro forma consolidated statement of

operations over a period ranging from 2 to 17.5 years. The primary fair value adjustments (on

which the pro forma adjustments are based) impacting SG&A expenses were to leasehold

interests ($185 million), property and equipment ($101 million) and internally developed

software ($12 million). This adjustment also includes management fees that are payable to

affiliates of certain of the Investors subsequent to the closing of the Merger and related

transactions (at an initial annual rate of $5.0 million which shall be increased by 5% for each

succeeding year during the term of the agreement).

(c) Represents $101.4 million of charges that are non-recurring in nature and directly attributable

to the Merger and related transactions. Such charges are comprised of $39.4 million of stock

compensation expense from the acceleration of unvested stock options, restricted stock and

restricted stock units as required as a result of the Merger and $62.0 million of transaction costs

we incurred that were expensed as one-time charges upon the close of the Merger. Such

adjustments do not include any adjustments to reflect the effects of our new stock based

compensation plan.

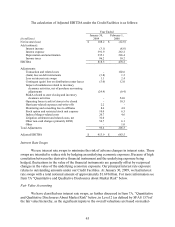

(d) Reflects pro forma interest expense resulting from our new capital structure as follows (in

millions):

Predecessor

Fiscal Year Ended

February 2, 2007

Period Ended

July 6, 2007

Revolving credit facility (1)

$

21.4

$

8.9

Term loan facilities (2)

177.8

74.1

Notes (3)

210.9

87.9

Letter of credit fees (4)

1.7

0.7

Bank commitment fees (5)

2.3

1.0

Other existing debt obligations (6)

7.2

3.0

Total cash interest expense

421.3

175.6

Amortization of capitalized debt issuance costs and debt discount (7)

9.8

4.1

Amortization of discounted liabilities (8)

8.5

3.5

Other (9)

(2.7)

0.6

Total pro forma interest expense

436.9

183.8

Less historical interest expense

(34.9)

(10.3)

Net adjustment to interest expense

$

402.0

$

173.5

(1) The $1.125 billion revolving credit facility carries an interest rate of 3-month LIBOR of 5.32% plus 1.50%

for tranche A loans and 3-month LIBOR of 5.32% plus 2.25% for tranche A-1 loans. Reflects assumed

borrowings of $175.0 million under tranche A and $125.0 million under tranche A-1. Such levels of borrowings

will fluctuate in future periods dependent upon short term cash needs. Changes in the levels of borrowings

would impact interest expense.