Blackberry 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

23

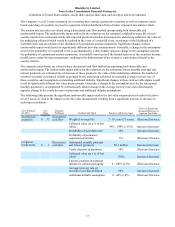

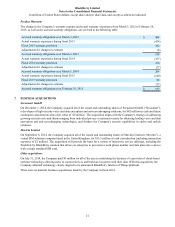

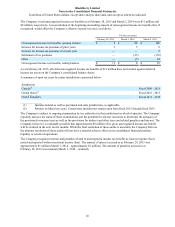

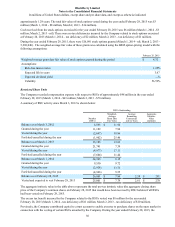

The following table sets forth the activity in the Company’s CORE program liability for fiscal 2015 and fiscal 2014:

Employee

Termination

Benefits Facilities

Costs Manufacturing

Costs Total

Balance as at March 2, 2013 $ 9 $ 18 $ 2 $ 29

Charges incurred 190 93 65 348

Cash payments made (186)(58)(41)(285)

Balance as at March 1, 2014 13 53 26 92

Charges incurred 96 48 55 199

Cash payments made (106)(71)(79)(256)

Balance as at February 28, 2015 $ 3 $ 30 $ 2 $ 35

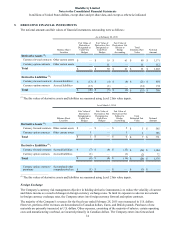

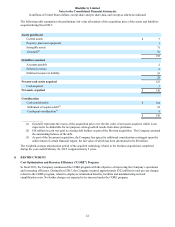

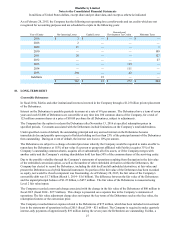

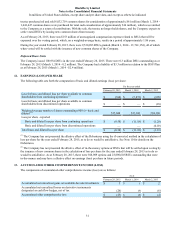

The CORE program charges incurred in fiscal 2015, fiscal 2014 and fiscal 2013 were as follows:

For the year ended

February 28, 2015 March 1, 2014 March 2, 2013

Cost of sales $ 23 $ 103 $ 96

Research and development 70 76 27

Selling, marketing and administration 229 333 97

Total CORE program charges $ 322 $ 512 $ 220

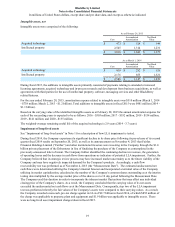

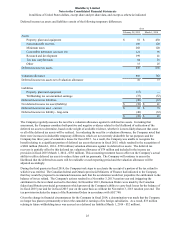

As part of the CORE program, the Company sold certain redundant assets and discontinued certain operations to drive

cost savings and efficiencies in the Company, which included divesting the majority of its Canadian commercial real

estate portfolio in fiscal 2015. The Company recorded losses of approximately $12 million in fiscal 2015 ($110 million in

fiscal 2014) related to asset disposals and the write-down to fair value less costs to sell of the assets sold, which has been

included in the selling, marketing and administration expenses on the Company’s consolidated statements of operations

and included in the total CORE program charges presented above.

In fiscal 2015, the Company strategically divested the majority of its Canadian commercial real estate portfolio (the “Real

Estate Sale”), offering properties comprising over 3 million square feet of space through a combination of sale-leaseback

and vacant asset sales. The Company recorded proceeds of approximately $278 million and incurred a net loss on disposal

of approximately $66 million on these properties for a total net loss on disposal of $137 million for the Real Estate Sale,

the remainder of which was recorded in prior periods when certain of the properties were classified as held for sale and

were written down to fair value less costs to sell. As part of the Real Estate Sale, the Company is leasing back office space

with remaining lease terms of one month to seven years.

In fiscal 2013, the Company sold 100% of the shares of its wholly-owned subsidiary, NewBay Software Limited

(“NewBay”) and as a result, the operating results of NewBay are presented as discontinued operations in the Company's

consolidated statements of operations for the fiscal year ended March 2, 2013.

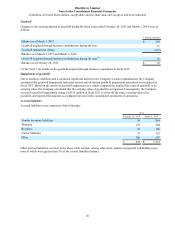

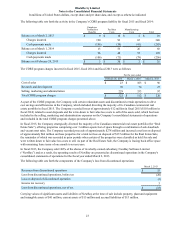

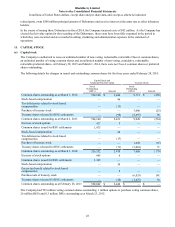

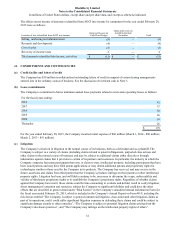

The following table sets forth the components of the Company’s loss from discontinued operations:

March 2, 2013

Revenues from discontinued operations $ 33

Loss from discontinued operations, before tax (20)

Loss on disposal of discontinued operation (3)

Income tax recovery 5

Loss from discontinued operations, net of tax $(18)

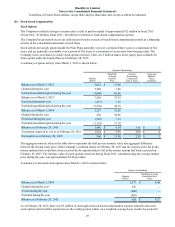

Carrying values of significant assets and liabilities of NewBay at the time of sale include property, plant and equipment

and intangible assets of $41 million, current assets of $15 million and accrued liabilities of $13 million.