Blackberry 2015 Annual Report Download - page 79

Download and view the complete annual report

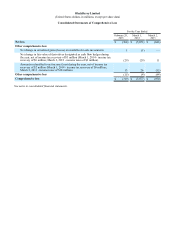

Please find page 79 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

4

The useful lives of intangible assets are evaluated quarterly to determine if events or circumstances warrant a revision to

their remaining period of amortization. Legal, regulatory and contractual factors, the effects of obsolescence, demand,

competition and other economic factors are potential indicators that the useful life of an intangible asset may be revised.

Impairment of long-lived assets

The Company reviews long-lived assets (“LLA”) such as property, plant and equipment and intangible assets with finite

useful lives for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset or

asset group may not be recoverable. These events and circumstances may include significant decreases in the market price

of an asset or asset group, significant changes in the extent or manner in which an asset or asset group is being used by the

Company or in its physical condition, a significant change in legal factors or in the business climate, a history or forecast

of future operating or cash flow losses, significant disposal activity, a significant decline in the Company's share price, a

significant decline in revenues or adverse changes in the economic environment.

When indicators of impairment exist, LLA impairment is tested using a two-step process. The Company performs a cash

flow recoverability test as the first step, which involves comparing the Company's estimated undiscounted future cash

flows to the carrying amount of its net assets, since the Company consists of one asset group. If the net cash flows of the

Company exceed the carrying amount of its net assets, LLA are not considered to be impaired. If the carrying amount

exceeds the net cash flows, there is an indication of potential impairment and the second step of the LLA impairment test

is performed to measure the impairment amount. The second step involves determining the fair value of the asset group,

the Company. Fair value should be determined using valuation techniques that are in accordance with U.S. GAAP,

including the market approach, income approach and cost approach. If the carrying amount of the Company's net assets

exceeds the fair value of the Company, then the excess represents the maximum amount of potential impairment that will

be allocated to the Company's assets on a relative basis, with the limitation that the carrying value of each asset cannot be

reduced to a value lower than its fair value. The total impairment amount allocated is recognized as a non-cash

impairment loss.

Business acquisitions

The Company accounts for its acquisitions using the acquisition method whereby identifiable assets acquired and

liabilities assumed are measured at their fair values as of the date of acquisition. The excess of the acquisition price over

such fair value, if any, is recorded as goodwill, which is not expected to be deductible for tax purposes. The Company

includes the operating results of each acquired business in the consolidated financial statements from the date of

acquisition.

Assets held for sale and discontinued operations

When certain criteria are met, the Company reclassifies assets and related liabilities as held for sale at the lower of their

carrying value or fair value less costs to sell and, if material, presents them separately on the Company’s consolidated

balance sheets. If the carrying value exceeds the fair value less costs to sell, a loss is recognized. If the plan to sell an asset

includes a leaseback arrangement for which the Company will retain more than a minor portion of the use of the asset,

then the asset is not reclassifed as held for sale as all criteria are deemed not to have been met. Assets classified as held

for sale are no longer amortized. Comparative figures are reclassified to conform to the current year’s presentation.

When the Company has disposed of or classified as held for sale a component of the entity, and certain criteria are met,

the results of operations of the component, including any loss recognized, are reported separately on the consolidated

statements of operations as discontinued operations. Discontinued operations are presented if the component’s operations

and cash flows have been, or will be, eliminated from the Company and the Company will not have significant continuing

involvement in the operations of the component after the disposal. Earnings (loss) per share amounts for both continuing

operations and discontinued operations are presented separately on the consolidated statements of operations and income

(loss) from continuing operations and loss from discontinued operations are reported separately on the consolidated

statements of cash flows. Comparative figures are reclassified to conform to the current year’s presentation.

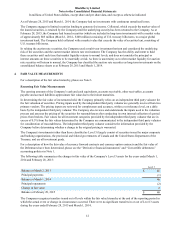

Royalties

The Company recognizes its liability for royalties in accordance with the terms of existing license agreements. Where

license agreements are not yet finalized, the Company recognizes its current estimates of the obligation in accrued

liabilities in the consolidated financial statements. When the license agreements are subsequently finalized, the estimate is

revised accordingly. Management’s estimates of royalty rates are based on the Company’s historical licensing activities,

royalty payment experience, and forward-looking expectations.