Blackberry 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

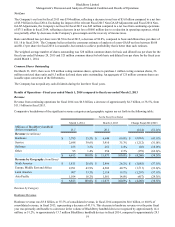

Management’s Discussion and Analysis of Financial Condition and Results of Operations

28

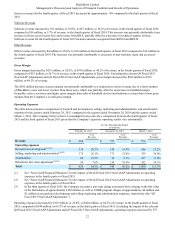

million, or 19.5%. The decrease was primarily attributable to decreases in salaries and benefit costs due to a reduction in

headcount related to the CORE program, as well as marketing and advertising costs and maintenance expense.

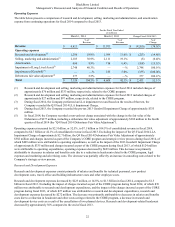

Operating expenses decreased by $666 million, or 61.1%, to $424 million, or 64.3% of revenue, in the fourth quarter of fiscal

2015, compared to $1.1 billion or 111.7% of revenue, in the fourth quarter of fiscal 2014. Excluding the impact of the relevant

Q4 Fiscal 2015 Non-GAAP Adjustments and Q4 Fiscal 2014 Non-GAAP Adjustments, operating expenses decreased by $260

million, or 45.1%. This decrease was primarily attributable to decreases in salaries and benefits due to a reduction in headcount

related to the CORE program, as well as marketing and advertising costs and amortization expense.

Research and Development Expense

Research and development expenses decreased by $112 million, or 45.5% to $134 million in the fourth quarter of fiscal 2015

compared to $246 million in the fourth quarter of fiscal 2014. Excluding the impact of the relevant Q4 Fiscal 2015 Non-GAAP

Adjustments and Q4 Fiscal 2014 Non-GAAP Adjustments, research and development expenses decreased by $97 million, or

43.1%. This decrease was primarily attributable to decreases in salaries and benefits costs due to a reduction in headcount

related to the CORE program and materials and facilities costs.

Selling, Marketing and Administration Expenses

Selling, marketing and administration expenses decreased by $183 million, or 51.5% to $172 million in the fourth quarter of

fiscal 2015 compared to $355 million in the fourth quarter of fiscal 2014. Excluding the impact of the relevant Q4 Fiscal 2015

Non-GAAP Adjustments and Q4 Fiscal 2014 Non-GAAP Adjustments, selling, marketing and administration expenses

decreased by $124 million, or 50.6%. This decrease was primarily attributable to decreases in foreign exchange expenses, and

marketing and advertising costs, as well as salaries and benefit costs due to a reduction in headcount related to the CORE

program.

Amortization Expense

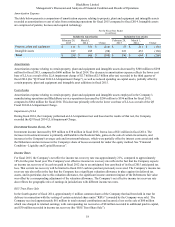

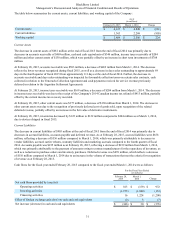

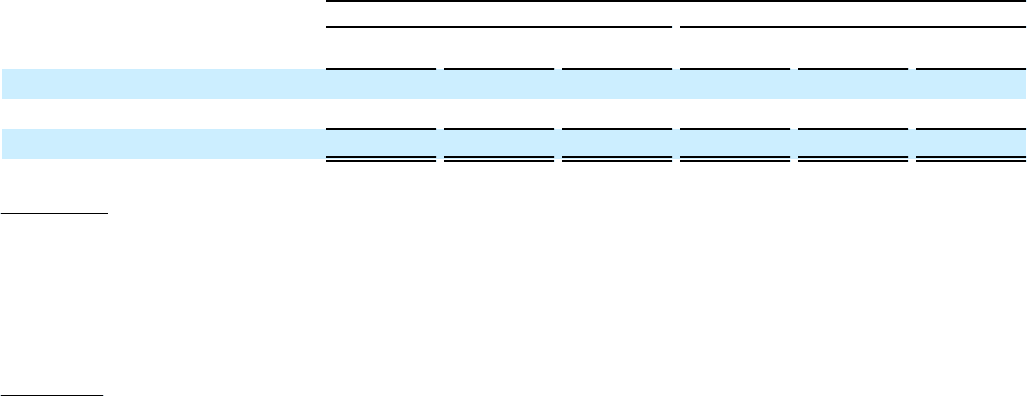

The table below presents a comparison of amortization expense relating to property, plant and equipment and intangible assets

recorded as amortization or cost of sales for the quarter ended February 28, 2015 compared to the quarter ended March 1, 2014.

Intangible assets are comprised of intellectual property and acquired technology.

For the Three Months Ended

(in millions)

Included in Amortization Included in Cost of sales

February 28,

2015 March 1,

2014 Change February 28,

2015 March 1,

2014 Change

Property, plant and equipment $ 23 $ 51 $ (28) $ 16 $ 16 $ —

Intangible assets 45 56 (11) 78 80 (2)

Total $ 68 $ 107 $ (39) $ 94 $ 96 $ (2)

Amortization

Amortization expense relating to certain property, plant and equipment and certain intangible assets decreased by $39 million to

$68 million for the fourth quarter of fiscal 2015 compared to $107 million for the fourth quarter of fiscal 2014. The decrease in

amortization expense reflects the lower cost base of assets as a result of the Real Estate Sale and additional asset sales, as well

as reduced spending on capital and intangible assets, partially offset by certain property, plant and equipment and intangible

asset additions in the fourth quarter of fiscal 2015.

Cost of sales

Amortization expense relating to certain property, plant and equipment and certain intangible assets employed in the

Company’s manufacturing operations and BlackBerry service operations decreased slightly by $2 million to $94 million for the

fourth quarter of fiscal 2015 compared to $96 million for the fourth quarter of fiscal 2014.

Investment Income (Loss), Net

Investment income increased by $125 million to $105 million in the fourth quarter of fiscal 2015 from a loss of $20 million in

the fourth quarter of fiscal 2014. The increase in investment income is primarily attributable to the Rockstar Sale, gains on the