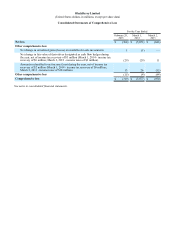

Blackberry 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

9

of components of an entity that represent strategic shifts that have (or will have) a major effect on an entity's operations

and financial results. The amendments also require expanded disclosures for discontinued operations and certain other

disposals that do not qualify for discontinued operations. The amendments are effective for all disposals (or classifications

as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014 and

interim periods within those years, with early adoption permitted. The Company will adopt this guidance in the first

quarter of fiscal 2016.

In May 2014, the FASB issued a new accounting standard on the topic of revenue contracts, which replaces the existing

revenue recognition standard. The new standard amends a number of requirements that an entity must consider in

recognizing revenue and requires improved disclosures to help readers of financial statements better understand the

nature, amount, timing and uncertainty of revenue recognized. For public entities, the new standard is effective for annual

reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early

adoption is not permitted. The Company will adopt this guidance in the first quarter of fiscal 2018 and is currently

evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

In June 2014, the FASB issued a new accounting standards update on the topic of repurchase-to-maturity transactions,

repurchase financings and disclosures. The amendments change the accounting for repurchase-to-maturity transactions

and linked repurchase financings to secured borrowing accounting. The amendments require an entity to disclose

information on transfers accounted for as sales in transactions that are economically similar to repurchase agreements and

provides increased transparency about the types of collateral pledged in repurchase agreements and similar transactions

accounted for as secured borrowings. The amendments are effective for public entities for the first interim or annual

period beginning after December 15, 2014. Early adoption for a public entity is prohibited. The Company will adopt this

guidance in the first quarter of fiscal 2016.

In June 2014, the FASB issued a new accounting standards update on the topic of stock compensation. The amendments

in this update require that a performance target that affects vesting and that could be achieved after the requisite service

period be treated as a performance condition. The amendments in this update are effective for annual periods and interim

periods within those annual periods beginning after December 15, 2015. Early adoption is permitted. The Company will

adopt this guidance in the first quarter of fiscal 2017.

In August 2014, the FASB issued a new accounting standards update on the topic of going concern. The amendments in

this update provide guidance about management’s responsibility to evaluate whether there is substantial doubt about an

entity’s ability to continue as a going concern and to provide related footnote disclosures. The amendments in this update

are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter.

Early adoption is permitted. The Company will adopt this guidance in the fourth quarter of fiscal 2017.

In February 2015, the FASB issued a new accounting standards update on the topic of consolidation. The amendments in

this update provide guidance on the consolidation evaluation for reporting organizations that are required to evaluate

whether they should consolidate certain legal entities. All legal entities are subject to reevaluation under the revised

consolidation model. The amendments in this update are effective for the annual period beginning after December 15,

2015. Early adoption is permitted. The Company will adopt this guidance in the first quarter of fiscal 2017 and is

currently evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

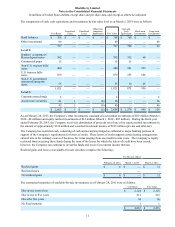

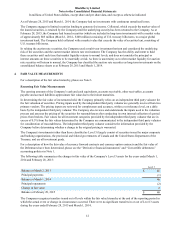

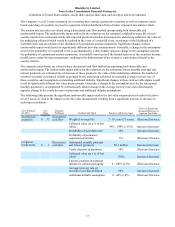

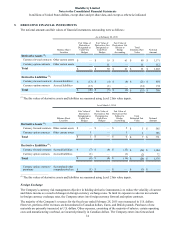

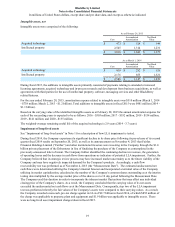

3. CASH, CASH EQUIVALENTS AND INVESTMENTS

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value measurements

for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous

market in which it would transact and considers assumptions that market participants would use in pricing the asset or

liability such as inherent risk, non-performance risk and credit risk. The Company applies the following fair value

hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value into three levels:

• Level 1 - Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

• Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and

liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or

other inputs that are observable or can be corroborated by observable market data.

• Level 3 - Significant unobservable inputs which are supported by little or no market activity.