Blackberry 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

26

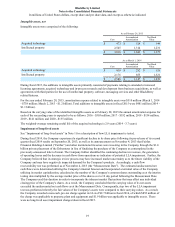

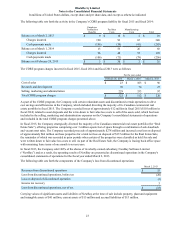

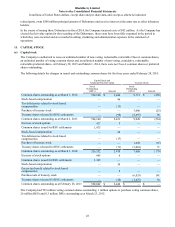

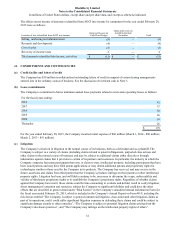

The Company’s total unrecognized income tax benefits as at February 28, 2015 and March 1, 2014 were $11 million and

$8 million, respectively. A reconciliation of the beginning and ending amount of unrecognized income tax benefits that, if

recognized, would affect the Company’s effective income tax rate is as follows:

For the year ended

February 28, 2015 March 1, 2014 March 2, 2013

Unrecognized income tax benefits, opening balance $ 8 $ 29 $ 146

Increase for income tax positions of prior years 3 5 9

Increase for income tax positions of current year — — 2

Settlement of tax positions — (23)(152)

Other — (3) 24

Unrecognized income tax benefits, ending balance $ 11 $ 8 $ 29

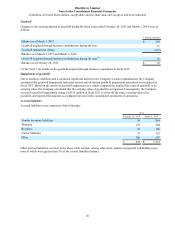

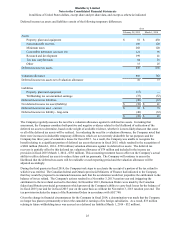

As at February 28, 2015, all of the unrecognized income tax benefits of $11 million have been netted against deferred

income tax assets on the Company’s consolidated balance sheets.

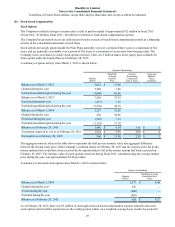

A summary of open tax years by major jurisdiction is presented below:

Jurisdiction

Canada(1) Fiscal 2009 - 2015

United States(2) Fiscal 2012 - 2015

United Kingdom Fiscal 2011 - 2015

_______________

(1) Includes federal as well as provincial and state jurisdictions, as applicable.

(2) Pertains to federal tax years. Certain state jurisdictions remain open from fiscal 2012 through fiscal 2015.

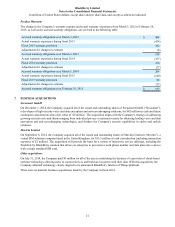

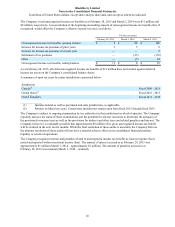

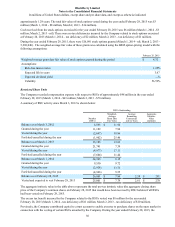

The Company is subject to ongoing examination by tax authorities in the jurisdictions in which it operates. The Company

regularly assesses the status of these examinations and the potential for adverse outcomes to determine the adequacy of

the provision for income taxes as well as the provisions for indirect and other taxes and related penalties and interest. The

Company believes it is reasonably possible that approximately $8 million of its gross unrecognized income tax benefit

will be realized in the next twelve months. While the final resolution of these audits is uncertain, the Company believes

the ultimate resolution of these audits will not have a material adverse effect on its consolidated financial position,

liquidity or results of operations.

The Company recognizes interest and penalties related to unrecognized income tax benefits as interest expense that is

netted and reported within investment income (loss). The amount of interest accrued as at February 28, 2015 was

approximately $1 million (March 1, 2014 – approximately $1 million). The amount of penalties accrued as at

February 28, 2015 was nominal (March 1, 2014 – nominal).