Blackberry 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

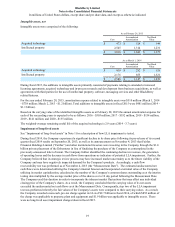

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

14

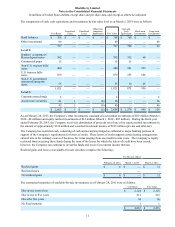

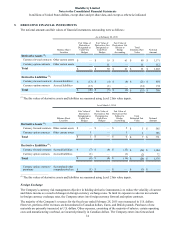

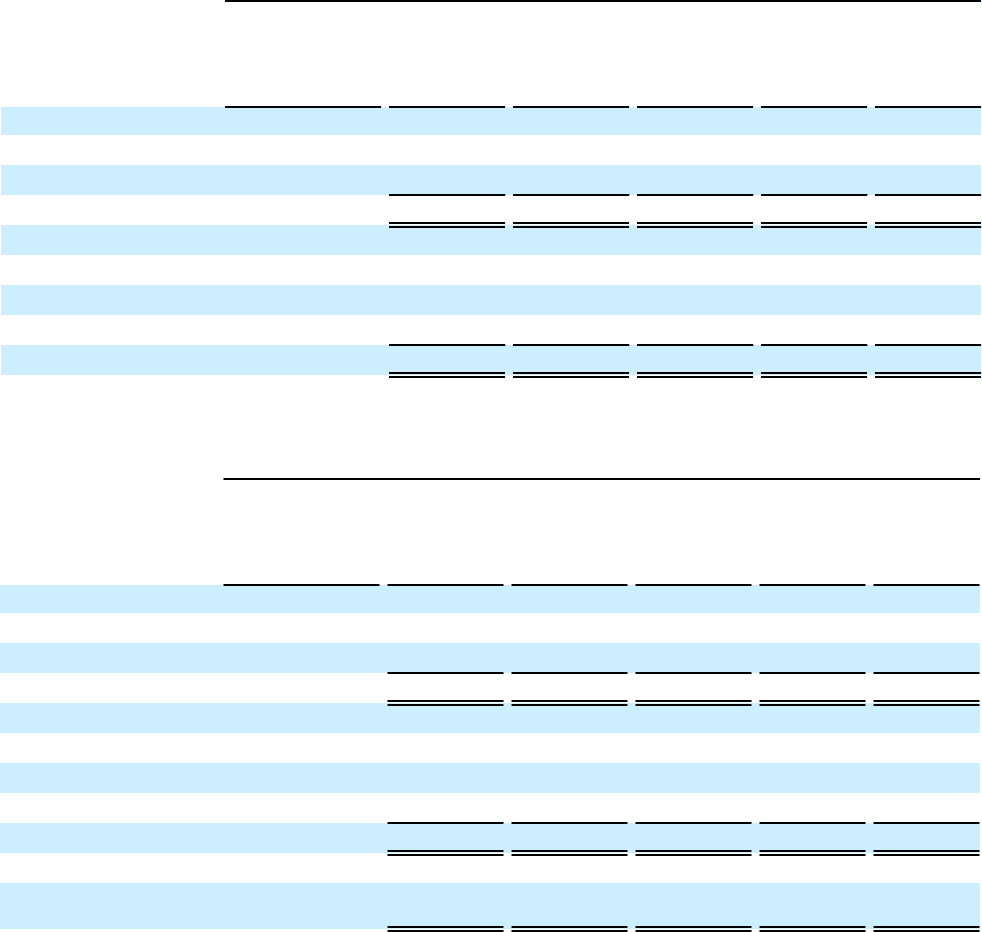

5. DERIVATIVE FINANCIAL INSTRUMENTS

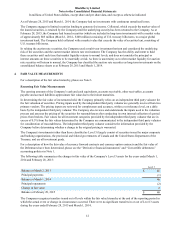

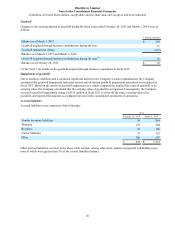

The notional amounts and fair values of financial instruments outstanding were as follows:

As at February 28, 2015

Balance Sheet

Location

Fair Value of

Derivatives

Designated as

Cash Flow

Hedges

Fair Value of

Derivatives Not

Designated as

Cash Flow

Hedges

Fair Value of

Derivatives Not

Subject to

Hedge

Accounting

Total

Estimated Fair

Value Notional

Amount

Derivative Assets (1):

Currency forward contracts Other current assets $ — $ 19 $ 61 $ 80 $ 1,171

Currency option contracts Other current assets — 11 — 11 112

Total $ — $ 30 $ 61 $ 91 $ 1,283

Derivative Liabilities (1):

Currency forward contracts Accrued liabilities $ (13) $ (4) $ (4) $ (21) $ 654

Currency option contracts Accrued liabilities (13) (1) — (14) 134

Total $ (26) $ (5) $ (4) $ (35) $ 788

______________________________

(1) The fair values of derivative assets and liabilities are measured using Level 2 fair value inputs.

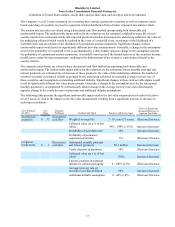

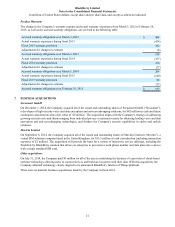

As at March 1, 2014

Balance Sheet

Location

Fair Value of

Derivatives

Designated as

Cash Flow

Hedges

Fair Value of

Derivatives Not

Designated as

Cash Flow

Hedges

Fair Value of

Derivatives Not

Subject to

Hedge

Accounting

Total

Estimated Fair

Value Notional

Amount

Derivative Assets (1):

Currency forward contracts Other current assets $ — $ — $ 5 $ 5 $ 585

Currency option contracts Other current assets 1 — 1 2 186

Total $ 1 $ — $ 6 $ 7 $ 771

Derivative Liabilities (1):

Currency forward contracts Accrued liabilities $ (7) $ (4) $ (15) $ (26) $ 1,304

Currency option contracts Accrued liabilities (1) — (1) (2) 72

Total $ (8) $ (4) $ (16) $ (28) $ 1,376

Currency option contracts -

premiums Accumulated other

comprehensive loss $ (1) $ — $ — $ (1) $ —

______________________________

(1) The fair values of derivative assets and liabilities are measured using Level 2 fair value inputs.

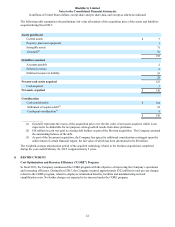

Foreign Exchange

The Company’s currency risk management objective in holding derivative instruments is to reduce the volatility of current

and future income as a result of changes in foreign currency exchange rates. To limit its exposure to adverse movements

in foreign currency exchange rates, the Company enters into foreign currency forward and option contracts.

The majority of the Company’s revenues for the fiscal year ended February 28, 2015 were transacted in U.S. dollars.

However, portions of the revenues are denominated in Canadian dollars, Euros, and British pounds. Purchases of raw

materials are primarily transacted in U.S. dollars. Other expenses, consisting of the majority of salaries, certain operating

costs and manufacturing overhead, are incurred primarily in Canadian dollars. The Company enters into forward and