Blackberry 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

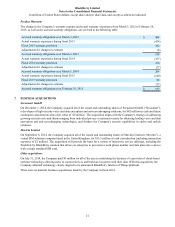

15

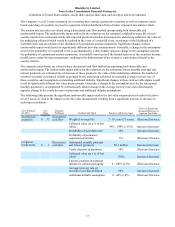

option contracts to hedge portions of these anticipated transactions to reduce the volatility on income associated with the

foreign currency exposures. The Company also enters into forward and option contracts to reduce the effects of foreign

exchange gains and losses resulting from the revaluation of certain foreign currency monetary assets and liabilities. At

February 28, 2015 approximately 26% of cash and cash equivalents, 30% of accounts receivables and 13% of accounts

payable and accrued liabilities are denominated in foreign currencies (March 1, 2014 – 35%, 26% and 12%).

Please see “Derivative financial instruments” in Note 1 for the Company’s accounting policies on these instruments.

As at February 28, 2015 and March 1, 2014, the outstanding derivatives designated as cash flow hedges were considered

to be fully effective. The maturity dates of these instruments range from March, 2015 to February, 2016. As at

February 28, 2015, the net unrealized loss on these forward and option contracts (including option premiums paid) was

$26 million (March 1, 2014 - net unrealized loss of $8 million). Unrealized gains associated with these contracts were

recorded in other current assets and accumulated other comprehensive income (loss). Unrealized losses were recorded in

accrued liabilities and AOCI. Option premiums were recorded in AOCI. As at February 28, 2015, the Company estimates

that approximately $26 million of net unrealized losses including option premiums on these forward and option contracts

will be reclassified into income within the next twelve months. For the fiscal year ended February 28, 2015, there were no

realized gains or losses on forward contracts which were ineffective upon maturity (fiscal year ended March 1, 2014 - $4

million in realized losses).

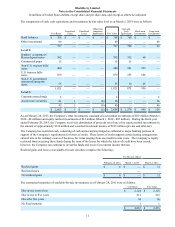

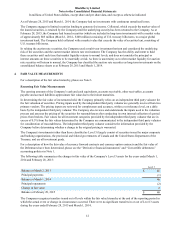

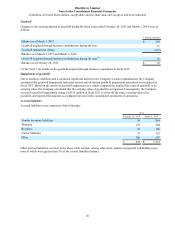

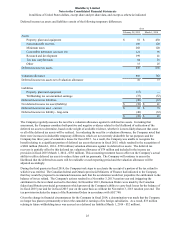

The following table shows the impact of derivative instruments designated as cash flow hedges on the consolidated

statements of operations and the consolidated statements of comprehensive income (loss) for the year ended February 28,

2015:

Amount of Gain (Loss)

Recognized in Other

Comprehensive Income on

Derivative Instruments

(Effective Portion)

Location of Gain (Loss) Reclassified

from AOCI into Income

(Effective Portion)

Amount of Gain (Loss)

Reclassified from

AOCI into Income

(Effective Portion)

Currency forward contracts (2) Cost of sales (1)

Currency option contracts (1) Cost of sales (1)

Currency forward contracts (3) Selling, marketing and administration (5)

Currency option contracts (7) Selling, marketing and administration (4)

Currency forward contracts (8) Research and development (3)

Currency option contracts (5) Research and development (1)