Blackberry 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

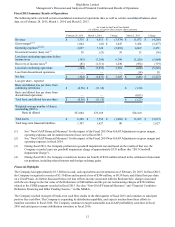

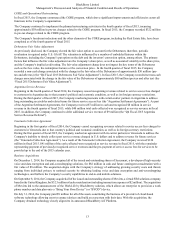

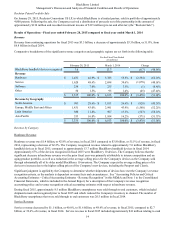

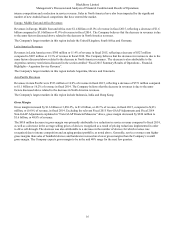

Management’s Discussion and Analysis of Financial Condition and Results of Operations

9

and competitive dynamics continue to be challenging to the Company's business and the Company cannot be certain of the

duration of these conditions and their potential impact on the Company's future financial results and cash flows. A continued

decline in the Company's performance, the Company's market capitalization and future changes to the Company's assumptions

and estimates used in the LLA impairment test, particularly the expected future cash flows, remaining useful life of the primary

asset and terminal value of the asset group, may result in further impairment charges in future periods of some or all of the

assets on the Company's balance sheet. Although it does not affect the Company's cash flow, an impairment charge to earnings

has the effect of decreasing the Company's earnings or increasing the Company's losses, as the case may be. The Company's

share price could also be adversely affected by the Company's recorded LLA impairment charges.

The Company used various valuation techniques to determine the fair values of its assets to measure and allocate impairment.

Techniques related to real estate, capital equipment and intangible assets included the direct capitalization method, market

comparable transactions, the replacement cost method, discounted cash flow analysis, as well as the relief from royalty and

excess earnings valuation methods. Determining valuations using these valuation techniques requires significant judgment and

assumptions by management. Different judgments could yield different results.

Inventory and Inventory Purchase Commitments

The Company’s policy for the valuation of inventory, including the determination of obsolete or excess inventory, requires

management to estimate the future demand for the Company’s products. Inventory purchases and purchase commitments are

based upon such forecasts of future demand and scheduled rollout and life cycles of new products. The business environment in

which the Company operates is subject to rapid changes in technology and customer demand. The Company performs an

assessment of inventory during each reporting period, which includes a review of, among other factors, demand requirements,

component part purchase commitments of the Company and certain key suppliers, product life cycle and development plans,

component cost trends, product pricing and quality issues. If customer demand subsequently differs from the Company’s

forecasts, requirements for inventory write-offs that differ from the Company’s estimates could become necessary. If

management believes that demand no longer allows the Company to sell inventories above cost or at all, such inventory is

written down to net realizable value or excess inventory is written off. Significant judgment was required in calculating the

inventory charges, which involved forecasting future demand and the associated pricing at which the Company can realize the

carrying value of its inventory.

Valuation Allowance Against Deferred Tax Assets

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. A valuation allowance is

required for deferred tax assets if it is more likely than not that all or some portion of the asset will not be realized. All available

evidence, both positive and negative, that may affect the realization of deferred tax assets must be identified and considered in

determining the appropriate amount of the valuation allowance. Additionally, for interim periods, the estimated annual effective

tax rate should include the valuation allowance for current year changes in temporary differences and losses or income arising

during the year. For interim periods, the Company needs to consider the valuation allowance that it expects to recognize at the

end of the fiscal year as part of the estimated annual effective tax rate. During interim quarters, the Company uses estimates

including pre-tax results and ending position of temporary differences as at the end of the fiscal year to estimate the valuation

allowance that it expects to recognize at the end of the fiscal year. This accounting treatment has no effect on the Company’s

actual ability to utilize deferred tax assets to reduce future cash tax payments. Different judgments could yield different

results. See “Results of Operations - Three months ended February 28, 2015 compared to three months ended March 1, 2014 -

Income Taxes”.

Assets Held for Sale

The Company applies judgment in determining whether the criteria for reclassifying assets as held for sale are met, including

the assessment of sale leaseback arrangements included in the plan to sell. Further, in determining fair values less costs to sell,

the Company utilizes third party appraisals, based on discounted cash flow or market comparable valuation approaches. The

Company estimates costs to sell based on historical costs incurred for similar transactions. Should any of the estimates change,

or if the actual proceeds of disposal differ from the estimate of fair value, it could have a material impact on earnings.

Revenue Recognition

Significant judgment is applied by the Company to determine whether shipments of devices have met the Company’s revenue

recognition criteria, as the analysis is dependent on many facts and circumstances. During fiscal 2014, the Company shipped

devices to its carrier and distributor partners to support new and continuing product launches and meet expected levels of end

customer demand. However, the sell-through levels for BlackBerry 10 devices decreased during fiscal 2014, causing the

number of BlackBerry 10 devices in the channel to increase above the Company's expectations. In order to improve sell-

through levels and stimulate global demand for BlackBerry 10 devices, the Company continued to execute on sell-through

programs and reduced the price on new shipments of BlackBerry 10 smartphones during fiscal 2014 and fiscal 2015. During