Blackberry 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

25

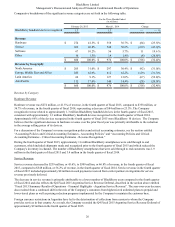

Fiscal 2013

• an income tax benefit of $166 million related to the settlement of uncertain tax positions, including related interest and

foreign exchange gains;

• the 2013 Goodwill Impairment Charge; and

• approximately $151 million, after-tax, of restructuring charges related to the Company's CORE program in fiscal

2013.

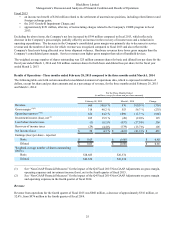

Excluding the above items, the Company's net loss increased by $394 million compared to fiscal 2013, which reflected a

decrease in the Company’s gross margin, partially offset by an increase in the recovery of income taxes and a reduction in

operating expenditures. The decrease in the Company's consolidated gross margin was primarily due to decreases in service

revenue and the number of devices for which revenue was recognized compared to fiscal 2013 and also reflected the

Company's fixed costs being allocated over lower shipment volumes. Hardware revenues have lower gross margins than the

Company’s consolidated gross margin. Service revenues earn higher gross margins than sales of handheld devices.

The weighted average number of shares outstanding was 525 million common shares for basic and diluted loss per share for the

fiscal year ended March 1, 2014 and 524 million common shares for both basic and diluted loss per share for the fiscal year

ended March 2, 2013.

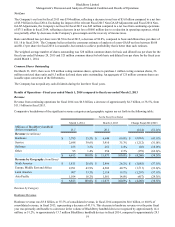

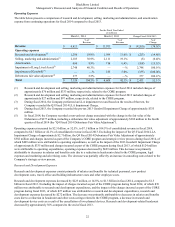

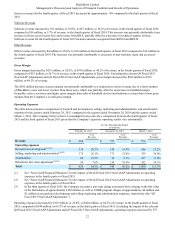

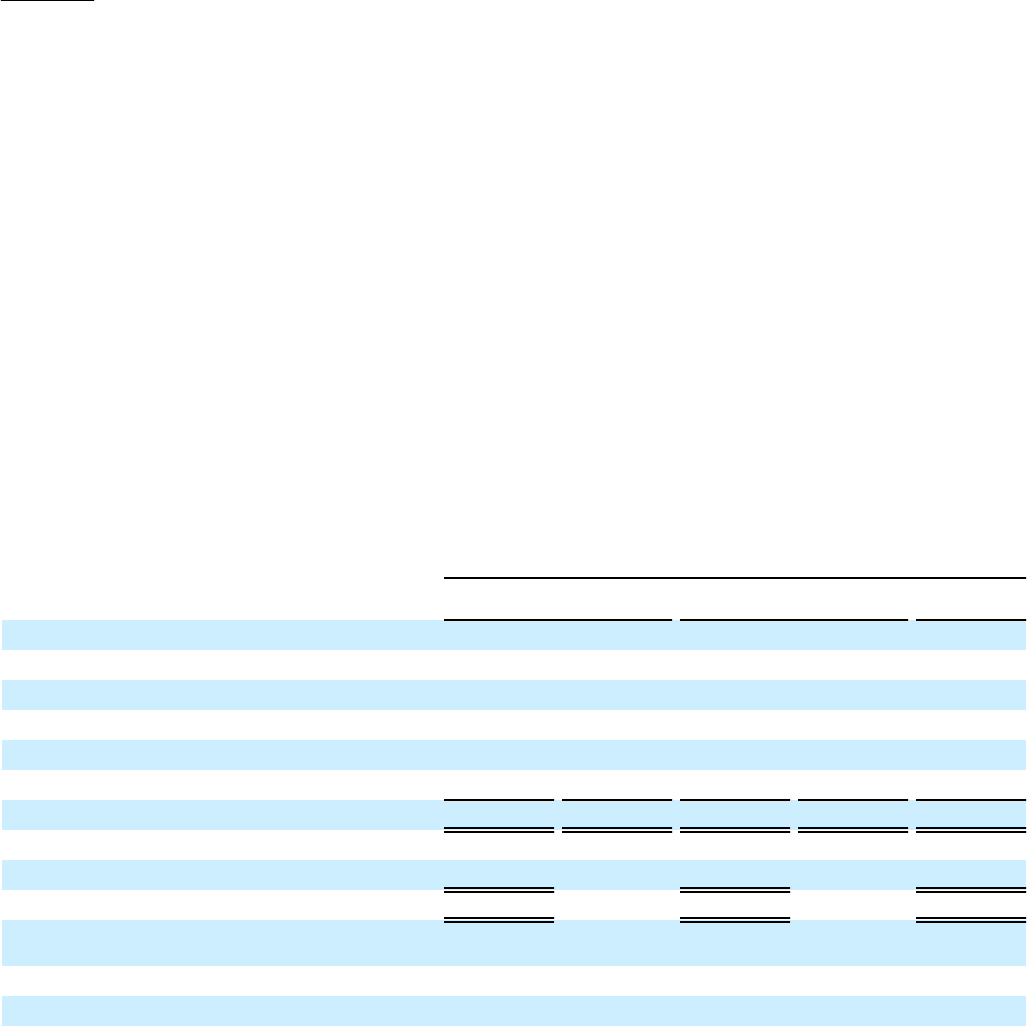

Results of Operations - Three months ended February 28, 2015 compared to the three months ended March 1, 2014

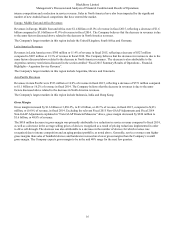

The following table sets forth certain unaudited consolidated statement of operations data, which is expressed in millions of

dollars, except for share and per share amounts and as a percentage of revenue, for the three months ended February 28, 2015

and March 1, 2014:

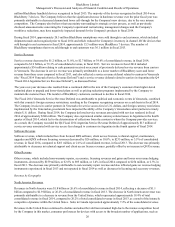

For the Three Months Ended

(in millions, except for share and per share amounts)

February 28, 2015 March 1, 2014 Change

Revenue 660 100.0 % 976 100.0 % (316)

Gross margin (1)(2) 318 48.2 % 553 56.7 % (235)

Operating expenses (1)(2) 424 64.2 % 1,090 111.7 % (666)

Investment income (loss), net (1) 105 15.9 % (20) (2.0)% 125

Loss before income taxes (1) (0.1)% (557) (57.0)% 556

Recovery of income taxes (29) (4.4)% (134) (13.7)% 105

Net income (loss) $ 28 4.3 % $ (423) (43.3)% $ 451

Earnings (loss) per share - reported

Basic $ 0.05 $ (0.80) $ 0.85

Diluted $ 0.05 $ (0.80) $ 0.85

Weighted-average number of shares outstanding

(000’s)

Basic 528,685 526,374

Diluted 543,556 526,374

_________________________

(1) See “Non-GAAP Financial Measures” for the impact of the Q4 Fiscal 2015 Non-GAAP Adjustments on gross margin,

operating expenses and investment income (loss), net in the fourth quarter of fiscal 2015.

(2) See “Non-GAAP Financial Measures” for the impact of the Q4 Fiscal 2014 Non-GAAP Adjustments on gross margin

and operating expenses in the fourth quarter of fiscal 2014.

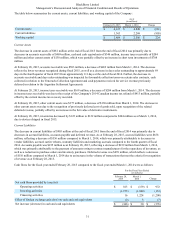

Revenue

Revenue from operations for the fourth quarter of fiscal 2015 was $660 million, a decrease of approximately $316 million, or

32.4%, from $976 million in the fourth quarter of fiscal 2014.