Blackberry 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

13

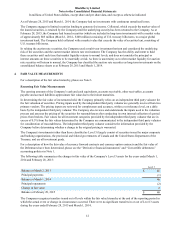

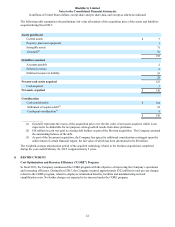

The Company’s Level 3 assets measured on a recurring basis include auction rate securities as well as corporate notes/

bonds consisting of securities received in a payment-in-kind distribution from a former structured investment vehicle.

The auction rate securities are valued using a discounted cash flow method incorporating both observable and

unobservable inputs. The unobservable inputs utilized in the valuation are the estimated weighted-average life of each

security based on its contractual details and expected paydown schedule based upon the underlying collateral, the value of

the underlying collateral which would be realized in the event of a waterfall event, an estimate of the likelihood of a

waterfall event, and an estimate of the likelihood of a permanent auction suspension. Significant changes in these

unobservable inputs would result in significantly different fair value measurements. Generally, a change in the assumption

used for the probability of a waterfall event is accompanied by a directionally opposite change in the assumption used for

the probability of a permanent auction suspension. A waterfall event occurs if the funded reserves of the securities become

insufficient to make the interest payments, resulting in the disbursement of the securities’ underlying collateral to the

security holders.

The corporate notes/bonds are valued using a discounted cash flow method incorporating both observable and

unobservable inputs. The unobservable inputs utilized in the valuation are the anticipated future monthly principal and

interest payments, an estimated rate of decrease of those payments, the value of the underlying collateral, the number of

securities currently in technical default as grouped by the underlying collateral, an estimated average recovery rate of

those securities, and assumptions surrounding additional defaults. Significant changes in these unobservable inputs would

result in significantly different fair value measurements. Generally, a change in the assumption used for the anticipated

monthly payments is accompanied by a directionally similar change in the average recovery rate and a directionally

opposite change in the yearly decrease in payments and additional defaults assumptions.

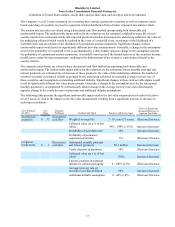

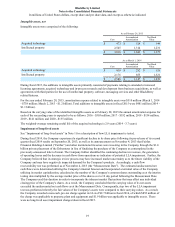

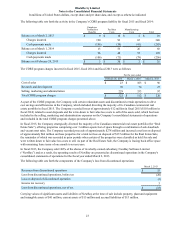

The following table presents the significant unobservable inputs used in the fair value measurement of each of the above

Level 3 assets, as well as the impact on the fair value measurement resulting from a significant increase or decrease in

each input in isolation:

As at February

28, 2015 Fair

Value Valuation

Technique Unobservable Input Range (weighted average)

Effect of Significant

Increase/(Decrease) in

Input on Fair Value

Auction rate

securities $ 37 Discounted

cash flow Weighted-average life 7 - 18 years (13 years) (Decrease)/increase

Collateral value (as a % of fair

value) 99% - 144% (115%) Increase/(decrease)

Probability of waterfall event 10% Increase/(decrease)

Probability of permanent

suspension of auction 5% (Decrease)/increase

Corporate

bonds/notes $ 3 Discounted

cash flow Anticipated monthly principal

and interest payments $0.1 million Increase/(decrease)

Yearly decrease in payments 10% (Decrease)/increase

Collateral value (as a % of fair

value) 138% Increase/(decrease)

Current securities in technical

default, by collateral grouping 0 - 100% (13%) (Decrease)/increase

Average recovery rate of

securities in technical default 30% Increase/(decrease)

Additional defaults assumption 0 - 44% (18%) (Decrease)/increase