Blackberry 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

12

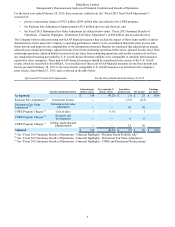

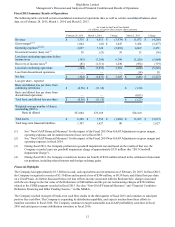

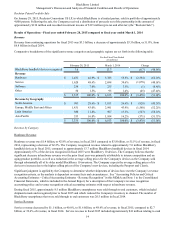

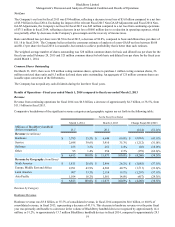

Fiscal 2015 Summary Results of Operations

The following table sets forth certain consolidated statement of operations data, as well as certain consolidated balance sheet

data, as at February 28, 2015, March 1, 2014, and March 2, 2013.

As at and for the Fiscal Year Ended

(in millions, except for share and per share amounts)

February 28, 2015 March 1, 2014 Change March 2, 2013 Change

Revenue $ 3,335 $ 6,813 $ (3,478) $ 11,073 $ (4,260)

Gross margin(1)(2) 1,604 (43) $ 1,647 3,434 (3,477)

Operating expenses(1)(2)(3) 2,027 7,120 (5,093) 4,669 2,451

Investment income (loss), net (1) 38 (21) 59 15 (36)

Loss from continuing operations before

income taxes (385) (7,184) 6,799 (1,220)(5,964)

Recovery of income taxes(4) (81) (1,311) 1,230 (592)(719)

Loss from continuing operations (304) (5,873) 5,569 (628)(5,245)

Loss from discontinued operations — — — (18) 18

Net loss $ (304) $ (5,873) $ 5,569 $ (646) $ (5,227)

Loss per share - reported

Basic and diluted loss per share from

continuing operations $ (0.58) $ (11.18) $ (1.20)

Basic and diluted loss per share from

discontinued operations — — (0.03)

Total basic and diluted loss per share $ (0.58) $ (11.18) $ (1.23)

Weighted-average number of shares

outstanding (000’s)

Basic & diluted 527,684 525,168 524,160

Total assets $ 6,549 $ 7,552 $ (1,003) $ 13,165 $ (5,613)

Total long-term financial liabilities 1,707 1,627 80 — 1,627

(1) See “Non-GAAP Financial Measures” for the impact of the Fiscal 2015 Non-GAAP Adjustments on gross margin,

operating expenses and investment income (loss), net in fiscal 2015.

(2) See “Non-GAAP Financial Measures” for the impact of the Fiscal 2014 Non-GAAP Adjustments on gross margin and

operating expenses in fiscal 2014.

(3) During fiscal 2013, the Company performed a goodwill impairment test and based on the results of that test, the

Company recorded a pre-tax goodwill impairment charge of approximately $335 million (the “2013 Goodwill

Impairment Charge”).

(4) During fiscal 2013, the Company recorded an income tax benefit of $166 million related to the settlement of uncertain

tax positions, including related interest and foreign exchange gains.

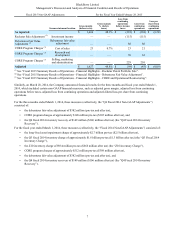

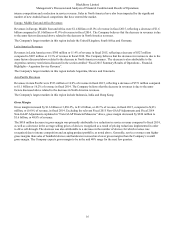

Financial Highlights

The Company had approximately $3.3 billion in cash, cash equivalents and investments as of February 28, 2015. In fiscal 2015,

the Company recognized revenues of $3.3 billion and incurred a loss of $304 million, or $0.58 basic and diluted loss per share

on a GAAP basis. As further discussed below, net loss reflects income associated with the Rockstar Sale, charges associated

with the net change in the fair value of the Debentures of $80 million and the pre-tax restructuring charges of $322 million

related to the CORE program recorded in fiscal 2015. See also “Non-GAAP Financial Measures” and “Financial Condition -

Debenture Financing and Other Funding Sources ” in this MD&A.

The Company reached its target of break-even cash flow results in the third quarter of fiscal 2015 and continues to anticipate

positive free cash flow. The Company is expanding its distribution capability, and expects traction from these efforts to

manifest sometime in fiscal 2016. The Company continues to target sustainable non-GAAP profitability sometime in fiscal

2016 and anticipates revenue stabilization sometime in fiscal 2016.