Blackberry 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

32

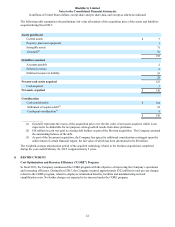

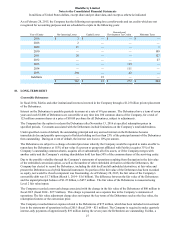

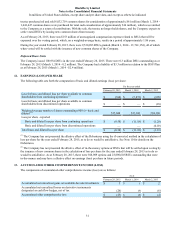

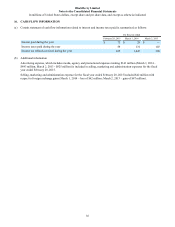

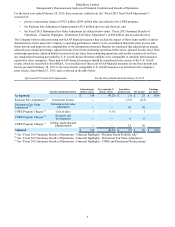

The effects on net income of amounts reclassified from AOCI into income by component for the year ended February 28,

2015 were as follows:

Location of loss reclassified from AOCI into income Gains and Losses on

Cash Flow Hedges

Gains and Losses on

Available-for-Sale

Securities Total

Selling, marketing and administration (9) — (9)

Research and development (4) — (4)

Cost of sales (2) — (2)

Recovery of income taxes 2 — 2

Total amount reclassified into income, net of tax $(13) $ — $ (13)

14. COMMITMENTS AND CONTINGENCIES

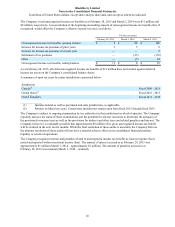

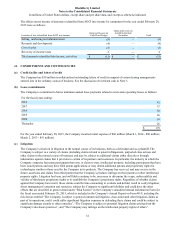

(a) Credit facility and letters of credit

The Company has $59 million in collateralized outstanding letters of credit in support of certain leasing arrangements

entered into in the ordinary course of business. See the discussion of restricted cash in Note 3.

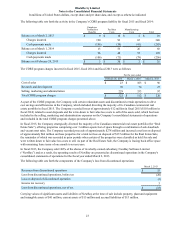

(b) Lease commitments

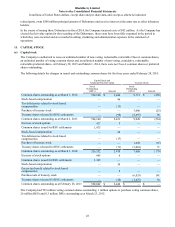

The Company is committed to future minimum annual lease payments related to real estate operating leases as follows:

For the fiscal years ending:

2016 42

2017 37

2018 30

2019 26

2020 18

Thereafter 26

$ 179

For the year ended February 28, 2015, the Company incurred rental expense of $60 million (March 1, 2014 - $80 million;

March 2, 2013 - $91 million).

(c) Litigation

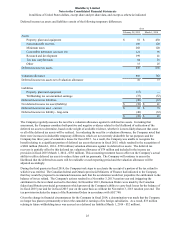

The Company is involved in litigation in the normal course of its business, both as a defendant and as a plaintiff. The

Company is subject to a variety of claims (including claims related to patent infringement, purported class actions and

other claims in the normal course of business) and may be subject to additional claims either directly or through

indemnities against claims that it provides to certain of its partners and customers. In particular, the industry in which the

Company competes has many participants that own, or claim to own, intellectual property, including participants that have

been issued patents and may have filed patent applications or may obtain additional patents and proprietary rights for

technologies similar to those used by the Company in its products. The Company has received, and may receive in the

future, assertions and claims from third parties that the Company’s products infringe on their patents or other intellectual

property rights. Litigation has been, and will likely continue to be, necessary to determine the scope, enforceability and

validity of third-party proprietary rights or to establish the Company’s proprietary rights. Regardless of whether claims

against the Company have merit, those claims could be time-consuming to evaluate and defend, result in costly litigation,

divert management’s attention and resources, subject the Company to significant liabilities and could have the other

effects that are described in greater detail under “Risk Factors” in the Company’s unaudited Annual Information Form for

the fiscal year ended February 28, 2015, which is included in the Company’s Annual Report on Form 40-F, including the

risk factors entitled “The Company is subject to general commercial litigation, class action and other litigation claims as

part of its operations, and it could suffer significant litigation expenses in defending these claims and could be subject to

significant damage awards or other remedies”, “The Company is subject to potential litigation claims arising from the

Company's disclosure practices”, and “The Company may infringe on the intellectual property rights of others”.