Blackberry 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

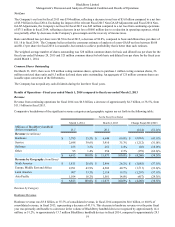

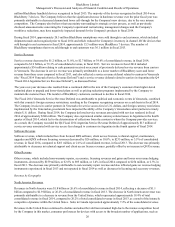

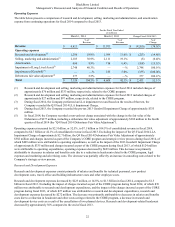

Management’s Discussion and Analysis of Financial Condition and Results of Operations

29

sale of certain investments, and increases in the Company's average cash and investment balances, which were partially offset

by interest costs associated with the Debentures. See “Financial Condition - Liquidity and Capital Resources” below.

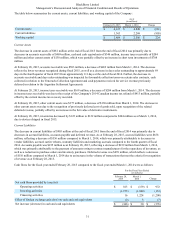

Income Taxes

For the fourth quarter of fiscal 2015, the Company’s net effective income tax expense rate was approximately 2900%,

compared to approximately 24% for the same period in the prior fiscal year. The Company’s net effective income tax recovery

rate reflects the fact that the Company expects an income tax recovery of its cash tax paid in fiscal 2012 due to an anticipated

loss carryback of its fiscal 2015 anticipated tax loss. That current tax recovery will be limited to fiscal 2012 cash tax paid not

previously recovered. The Company’s income tax recovery rate also reflects the fact that the Company has a significant

valuation allowance in place against its deferred tax assets, and in particular, due to this valuation allowance, the significant

income statement impact of the Debentures fair value was offset by a corresponding adjustment of the valuation allowance. The

Company’s net effective income tax recovery rate also reflects the geographic mix of earnings in jurisdictions with different

income tax rates. See also “Results of Operations - Fiscal year ended February 28, 2015 compared to fiscal year ended

March 1, 2014 - Income Taxes - RSU Trust Share Sale” in this MD&A.

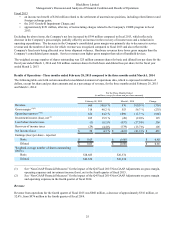

Net Income

The Company’s net income for the fourth quarter of fiscal 2015 was $28 million, or $0.05 basic and diluted earnings per share

on a GAAP basis, reflecting an increase in net income of $451 million compared to a net loss from continuing operations of

$423 million, or $0.80 basic and diluted loss per share, in the fourth quarter of fiscal 2014. Excluding the impact of the relevant

Q4 Fiscal 2015 Non-GAAP Adjustments and Q4 Fiscal 2014 Non-GAAP Adjustments, the Company's net income was $20

million compared to a net loss of $42 million, reflecting an increase in net income of $62 million due to a reduction in

operating expenditures, which was partially offset by decreases in the recovery of income taxes and the Company's gross

margin.

The weighted average number of shares outstanding was 529 million common shares for basic earnings per share and 544

million common shares for diluted earnings per share for the fourth quarter of fiscal 2015. The weighted average number of

shares outstanding was 526 million common shares for basic and diluted loss per share for the fourth quarter of fiscal 2014.