Blackberry 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

24

competition, changes in the Company’s results of operations, and changes in the Company’s forecasts or market expectations

relating to future results.

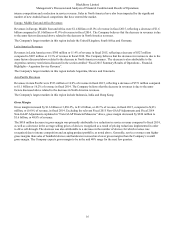

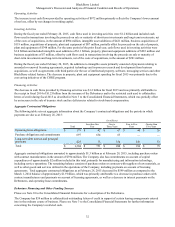

Investment Income

Investment income decreased by $36 million to a loss of $21 million in fiscal 2014, from a gain of $15 million in fiscal 2013.

The decrease primarily reflected interest costs associated with the Debentures, certain one-time gains recorded in fiscal 2013

not repeated in fiscal 2014, recognition of the Company's portion of investment losses in its equity-based investments and the

decreases in the Company's average cash and investment balances and yield. The decrease was partially offset by the accrual

of interest income for other tax matters.

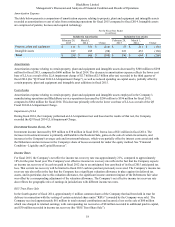

Income Taxes

For fiscal 2014, the Company’s income tax recovery from continuing operations was $1.3 billion, resulting in an effective

income tax recovery rate of approximately 18.2%, compared to income tax recovery of $592 million and an effective income

tax rate of approximately 48.5% for the prior fiscal year. The Company's effective income tax recovery rate reflects the

geographic mix of earnings in jurisdictions with different tax rates. The Company's lower effective income tax recovery rate in

fiscal 2014 primarily reflected certain charges related to the Q3 Fiscal 2014 LLA Impairment Charge resulting in the

recognition of a deferred tax valuation allowance, which is more fully described below.

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. In making that assessment,

the Company considers both positive and negative evidence related to the likelihood of realization of the deferred tax assets to

determine, based on the weight of available evidence, whether it is more-likely-than-not that some or all of the deferred tax

assets will be realized. In evaluating the need for a valuation allowance, the Company noted that there were significant

increases in deductible temporary differences in the third quarter of fiscal 2014 in relation to the Q3 Fiscal 2014 LLA

Impairment Charge, which was not currently deductible for tax purposes. In addition, the Company had three years of

cumulative losses for fiscal 2014. As a result, the Company was unable to recognize the benefit relating to a significant portion

of deferred tax assets that arose in fiscal 2014, which resulted in a $783 million valuation allowance against its deferred tax

assets. The deferred tax recovery was partially offset by this deferred tax valuation allowance of $781 million and included in

the income tax provision in fiscal 2014. This accounting treatment has no effect on the Company’s actual ability to utilize

deferred tax assets to reduce future cash tax payments. The Company will continue to assess the likelihood that the deferred tax

assets will be realizable at each reporting period and the valuation allowance will be adjusted accordingly.

During the third quarter of fiscal 2014, the Company took steps to accelerate the receipt of a portion of the tax refund to which

it was entitled. The Canadian federal and Ontario provincial Ministers of Finance had indicated to the Company that they

would be prepared to recommend measures such that the acceleration would not jeopardize the Company's potential entitlement

to the balance of its tax refund. The Company's actions resulted in a November 3, 2013 taxation year end, which triggered the

entitlement to the accrued tax refund of $696 million, which the Company received in the third quarter of fiscal 2014. In

December 2013, Remission Orders were made by the Canadian federal and Ontario provincial governments which preserved

the Company's ability to carry back losses for the balance of fiscal 2014 and for fiscal 2015 on the same basis as without the

November 3, 2013 taxation year end. The tax provision included the impact of the Remission Orders in accordance with ASC

740 because they were made in the fourth quarter.

Given the change in the Company's financial circumstances in the third quarter of fiscal 2014, the Company provided for

foreign withholding taxes of $32 million that would apply on the distribution of the earnings of its non-Canadian subsidiaries.

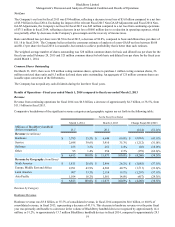

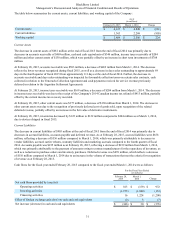

Net Loss

The Company’s net loss from continuing operations for fiscal 2014 was $5.9 billion or $11.18 per share (basic and diluted),

reflecting an increase in net loss of $5.2 billion compared to net loss from continuing operations of $628 million, or $1.20 per

share (basic and diluted) in fiscal 2013. The increase in net loss from continuing operations included the impact in fiscal 2014

and 2013 of:

Fiscal 2014

• the Q3 Fiscal 2014 LLA Impairment Charge;

• the Q3 Fiscal 2014 Inventory Charge;

• the Z10 Inventory Charge;

• the Q4 Fiscal 2014 Debentures Fair Value Adjustment;

• restructuring charges of approximately $398 million, after tax, related to the Company’s CORE program and strategic

review process; and

• the Q4 Fiscal 2014 Inventory Recovery.