Blackberry 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

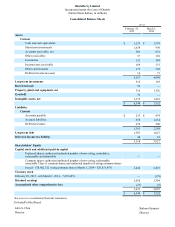

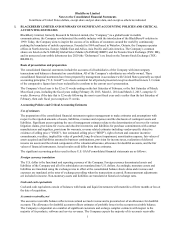

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

3

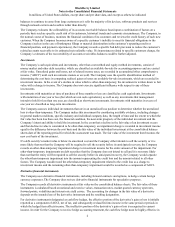

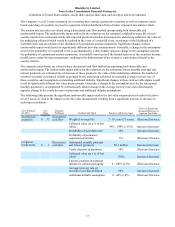

offsetting changes in the fair value of the hedged item and the relationship between the hedging instrument and the

associated hedged item must be formally documented at the inception of the hedge relationship. Hedge effectiveness is

formally assessed, both at hedge inception and on an ongoing basis, to determine whether the derivatives used in hedging

transactions are highly effective in offsetting changes in the value of the hedged items and whether they are expected to

continue to be highly effective in future periods.

The Company formally documents relationships between hedging instruments and associated hedged items. This

documentation includes: identification of the specific foreign currency asset, liability or forecasted transaction being

hedged; the nature of the risk being hedged; the hedge objective; and the method of assessing hedge effectiveness. If an

anticipated transaction is deemed no longer likely to occur, the corresponding derivative instrument is de-designated as a

hedge and any associated unrealized gains and losses in AOCI are recognized in income at that time. Any future changes

in the fair value of the instrument are recognized in current income.

For any derivative instruments that do not meet the requirements for hedge accounting, or for any derivative instruments

for which hedge accounting is not elected, the changes in fair value of the instruments are recognized in income in the

current period and will generally offset the changes in the U.S. dollar value of the associated asset, liability or forecasted

transaction.

Inventories

Raw materials, work in process and finished goods are stated at the lower of cost or market value. Cost includes the cost

of materials plus direct labour applied to the product and the applicable share of manufacturing overhead. Cost is

determined on a first-in-first-out basis. Market is generally considered to be replacement cost; however, market is not

permitted to exceed the ceiling (net realizable value) or be less than the floor (net realizable value less a normal markup).

Net realizable value is defined as the estimated selling price in the ordinary course of business, less reasonably predictable

costs of completion and disposal.

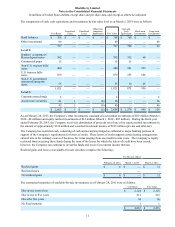

Property, plant and equipment, net

Property, plant and equipment are stated at cost, less accumulated amortization. No amortization is provided for

construction in progress until the assets are ready for use. Amortization is provided using the following rates and methods:

Buildings, leasehold improvements and other Straight-line over terms between 5 and 40 years

BlackBerry operations and other information technology Straight-line over terms between 3 and 5 years

Manufacturing equipment, research and development

equipment and tooling Straight-line over terms between 1 and 8 years

Furniture and fixtures Declining balance at 20% per annum

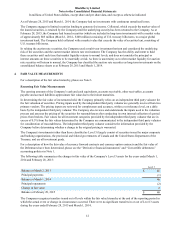

Goodwill

Goodwill represents the excess of the acquisition price over the fair value of identifiable net assets acquired. Goodwill is

allocated at the date of the business combination. Goodwill is not amortized, but is tested for impairment annually, during

the fourth quarter, or more frequently if events or changes in circumstances indicate the asset may be impaired. These

events and circumstances may include a significant change in legal factors or in the business climate, a significant decline

in the Company’s share price, an adverse action or assessment by a regulator, unanticipated competition, a loss of key

personnel, significant disposal activity and the testing of recoverability for a significant asset group.

The Company consists of a single reporting unit. The impairment test is carried out in two steps. In the first step, the

carrying amount of the reporting unit including goodwill is compared with its fair value. The estimated fair value is

determined utilizing a market-based approach, based on the quoted market price of the Company’s stock in an active

market, adjusted by an appropriate control premium. When the carrying amount of a reporting unit exceeds its fair value,

goodwill of the reporting unit is considered to be impaired and the second step is necessary. In the second step, the

implied fair value of the reporting unit's goodwill is compared with its carrying amount to measure the amount of the

impairment loss, if any.

Intangible assets

Intangible assets with definite lives are stated at cost, less accumulated amortization. The Company is currently

amortizing its intangible assets with finite lives over periods generally ranging between 2 to 17 years.