Blackberry 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

25

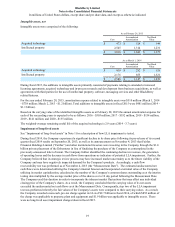

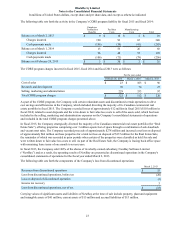

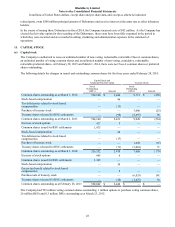

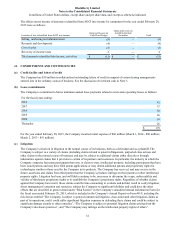

Deferred income tax assets and liabilities consist of the following temporary differences:

As at

February 28, 2015 March 1, 2014

Assets

Property, plant and equipment $ 81 $ 430

Non-deductible reserves 108 120

Minimum taxes 268 120

Convertible debenture (see note 10) 121 95

Research and development 199 41

Tax loss carryforwards 84 25

Other 15 25

Deferred income tax assets 876 856

Valuation allowance 866 783

Deferred income tax assets net of valuation allowance 10 73

Liabilities

Property, plant and equipment (15) —

Withholding tax on unremitted earnings (33)(32)

Deferred income tax liabilities (48)(32)

Net deferred income tax asset/(liability) $ (38) $ 41

Deferred income tax asset - current $ 10 $ 73

Deferred income tax liability - long-term (48)(32)

$(38) $ 41

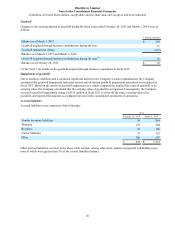

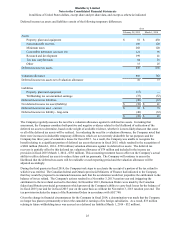

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. In making that

assessment, the Company considers both positive and negative evidence related to the likelihood of realization of the

deferred tax assets to determine, based on the weight of available evidence, whether it is more-likely-than-not that some

or all of the deferred tax assets will be realized. In evaluating the need for a valuation allowance, the Company noted that

there were increases in deductible temporary differences which are not currently deductible for tax purposes and the

Company has three years of cumulative losses for fiscal 2015. As a result, the Company was unable to recognize the

benefit relating to a significant portion of deferred tax assets that arose in fiscal 2015, which resulted in the recognition of

a $866 million (March 1, 2014 - $783 million) valuation allowance against its deferred tax assets. The deferred tax

recovery is partially offset by this deferred tax valuation allowance of $79 million and included in the income tax

provision in fiscal 2015 (March 1, 2014 - $781 million). This accounting treatment has no effect on the Company’s actual

ability to utilize deferred tax assets to reduce future cash tax payments. The Company will continue to assess the

likelihood that the deferred tax assets will be realizable at each reporting period and the valuation allowance will be

adjusted accordingly.

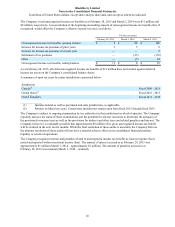

During the third quarter in fiscal 2014, the Company took steps to accelerate the receipt of a portion of the tax refund to

which it was entitled. The Canadian federal and Ontario provincial Ministers of Finance had indicated to the Company

that they would be prepared to recommend measures such that the acceleration would not jeopardize the entitlement to the

balance of its tax refund. The Company's actions resulted in a November 3, 2013 taxation year end (triggering the

entitlement to the tax refund accrued to that date). In December 2013, Remission Orders were made by the Canadian

federal and Ontario provincial governments which preserved the Company's ability to carry back losses for the balance of

its fiscal 2015 year and for its fiscal 2015 year on the same basis as without the November 3, 2013 taxation year end. The

tax provision includes the impact of the Remission Orders in accordance with ASC 740.

Given the change in financial circumstances for the Company in fiscal 2014, a determination was made that the Company

no longer has plans to permanently reinvest the cumulative earnings of its foreign subsidiaries. As a result, $33 million

relating to future withholding taxes was accrued as a deferred tax liability (March 1, 2014 - $32 million).