Blackberry 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

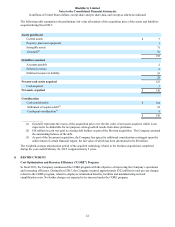

17

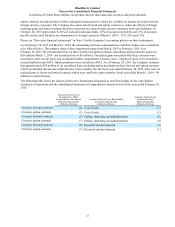

For information concerning the impact of foreign exchange on the consolidated statement of operations net of the above

derivative instruments, please see Note 16.

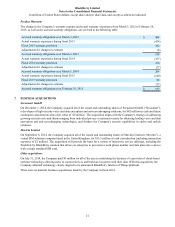

Credit Risk

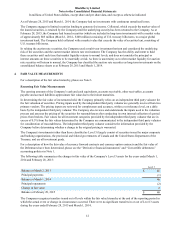

The Company is exposed to credit risk on derivative financial instruments arising from the potential for counterparties to

default on their contractual obligations. The Company mitigates this risk by limiting counterparties to highly rated

financial institutions and by continuously monitoring their creditworthiness. The Company’s exposure to credit loss and

market risk will vary over time as a function of currency exchange rates. The Company measures its counterparty credit

exposure as a percentage of the total fair value of the applicable derivative instruments. Where the net fair value of

derivative instruments with any counterparty is negative, the Company deems the credit exposure to that counterparty to

be nil. As at February 28, 2015, the maximum credit exposure to a single counterparty, measured as a percentage of the

total fair value of derivative instruments with net unrealized gains, was 47% (March 1, 2014 - 100%; March 2, 2013 -

29%). As at February 28, 2015, the Company had a total credit risk exposure across all counterparties with outstanding or

unsettled foreign exchange derivative instruments of $56 million on a notional value of $2.1 billion (March 1, 2014 - nil

total risk exposure on a notional value of $11 million).

The Company maintains Credit Support Annexes (“CSAs”) with several of its counterparties. These CSAs require that the

outstanding net position of all contracts to be made whole by the paying or receiving of collateral to or from the

counterparties on a daily basis, subject to exposure and transfer thresholds. As at February 28, 2015, the Company held

$15 million of collateral from counterparties, which approximated the fair value of those contracts. As with the derivatives

recorded in an unrealized gain position, this amount is recorded in other current assets.

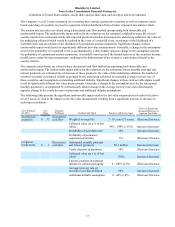

The Company is exposed to market and credit risk on its investment portfolio. The Company reduces this risk by

investing in liquid, investment grade securities and by limiting exposure to any one entity or group of related entities. As

at February 28, 2015, no single issuer represented more than 28% of the total cash, cash equivalents and investments

(March 1, 2014 - no single issuer represented more than 33% of the total cash and cash equivalents and investments, and

that issuer was the United States Department of Treasury).

Interest Rate Risk

Cash and cash equivalents and investments are invested in certain instruments of varying maturities. Consequently, the

Company is exposed to interest rate risk as a result of holding investments of varying maturities. The fair value of

investments, as well as the investment income derived from the investment portfolio, will fluctuate with changes in

prevailing interest rates. The Company has also issued the Debentures with a fixed interest rate. Consequently, the

Company is exposed to interest rate risk as a result of the long term of the Debentures. The fair value of the Debentures

will fluctuate with changes in prevailing interest rates. The Company does not currently utilize interest rate derivative

instruments to hedge its investment portfolio.

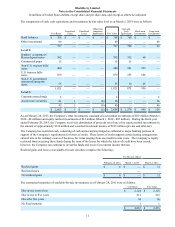

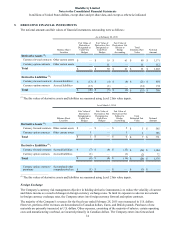

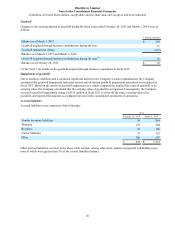

6. CONSOLIDATED BALANCE SHEETS DETAILS

Accounts receivable, net

The allowance for doubtful accounts as at February 28, 2015 is $10 million (March 1, 2014 - $17 million).

There were no customers that comprised more than 10% of accounts receivable as at February 28, 2015 (March 1, 2014 –

no customers that comprised more than 10%).

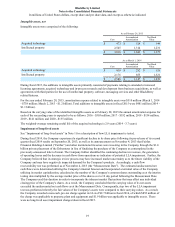

Inventories

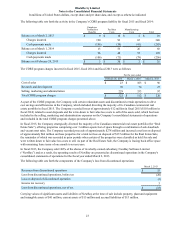

Inventories were comprised of the following:

As at

February 28, 2015 March 1, 2014

Raw materials $ 11 $ 51

Work in process 62 156

Finished goods 49 37

$ 122 $ 244