Blackberry 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

7

allocated using the residual method. Under the residual method, the amount of revenue allocated to delivered elements

equals the total arrangement consideration, less the aggregate fair value of any undelivered elements. If VSOE of any

undelivered software items does not exist, revenue from the entire arrangement is initially deferred and recognized at the

earlier of: (i) delivery of those elements for which VSOE did not exist; or (ii) when VSOE can be established.

The Company determines BESP for a product or service by considering multiple factors including, but not limited to,

historical pricing practices for similar offerings, market conditions, competitive landscape, internal costs, gross margin

objectives and pricing practices. The determination of BESP is made through consultation with, and formal approval by,

the Company’s management, taking into consideration the Company’s marketing strategy. The Company regularly

reviews VSOE, TPE and BESP, and maintains internal controls over the establishment and updates of these estimates.

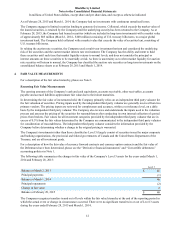

Based on the above factors, the Company’s BESP for the unspecified software upgrade right and non-software services

ranges from $10-$20 per BlackBerry 10 device based on the region in which the service is provided.

Income taxes

The Company uses the liability method of income tax allocation to account for income taxes. Deferred income tax assets

and liabilities are recognized based upon temporary differences between the financial reporting and income tax bases of

assets and liabilities, and measured using enacted income tax rates and laws that will be in effect when the differences are

expected to reverse. The Company records a valuation allowance to reduce deferred income tax assets to the amount that

is more likely than not to be realized. The Company considers both positive evidence and negative evidence, to determine

whether, based upon the weight of that evidence, a valuation allowance is required. Judgment is required in considering

the relative impact of negative and positive evidence.

Significant judgment is also required in evaluating the Company’s uncertain income tax positions and provisions for

income taxes. Liabilities for uncertain income tax positions are recognized based on a two-step approach. The first step is

to evaluate whether an income tax position has met the recognition threshold by determining if the weight of available

evidence indicates that it is more likely than not to be sustained upon examination. The second step is to measure the

income tax position that has met the recognition threshold as the largest amount that is more than 50% likely of being

realized upon settlement. The Company continually assesses the likelihood and amount of potential adjustments and

adjusts the income tax provisions, income taxes payable and deferred income taxes in the period in which the facts that

give rise to a revision become known. The Company recognizes interest and penalties related to uncertain income tax

positions as interest expense, which is then netted and reported within investment income.

The Company uses the flow-through method to account for investment tax credits (“ITCs”) earned on eligible scientific

research and experimental development expenditures. Under this method, the ITCs are recognized as a reduction to

income tax expense.

Research and development

Research costs are expensed as incurred. Development costs for BlackBerry devices and licensed software to be sold,

leased or otherwise marketed are subject to capitalization beginning when a product’s technological feasibility has been

established and ending when a product is available for general release to customers. The Company’s products are

generally released soon after technological feasibility has been established and therefore costs incurred subsequent to

achievement of technological feasibility are not significant and have been expensed as incurred.

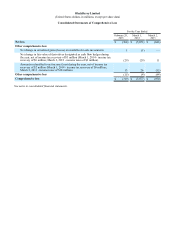

Comprehensive income

Comprehensive income is defined as the change in net assets of a business enterprise during a period from transactions

and other events and circumstances from non-owner sources and includes all changes in equity during a period except

those resulting from investments by owners and distributions to owners. The Company’s reportable items of

comprehensive income are cash flow hedges as described in Note 5 and changes in the fair value of available-for-sale

investments as described in Note 4. Realized gains or losses on available-for-sale investments are reclassified into

investment income using the specific identification basis.

Earnings (loss) per share

Earnings (loss) per share is calculated based on the weighted average number of common shares outstanding during the

year. The treasury stock method is used for the calculation of the dilutive effect of stock options.

Stock-based compensation plans

The Company has stock-based compensation plans. Awards granted under the plans are detailed in Note 11(b).