Blackberry 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

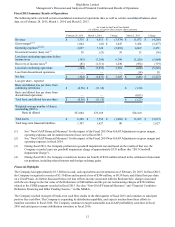

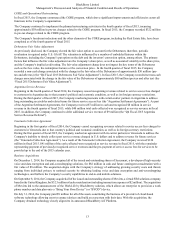

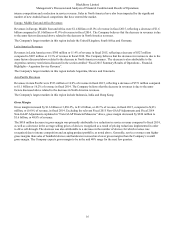

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

20

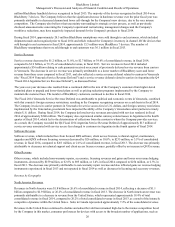

million BlackBerry handheld devices recognized in fiscal 2013. The majority of the devices recognized in fiscal 2014 were

BlackBerry 7 devices. The Company believes that the significant decrease in hardware revenue over the prior fiscal year was

primarily attributable to decreased demand and lower sell-through for the Company's new devices, due to the very intense

competition. The Company also believes that uncertainty surrounding its strategic review process, as well as previously

disclosed announcements concerning the Company's operational restructuring, management changes and the Company's

workforce reductions, may have negatively impacted demand for the Company's products in fiscal 2014.

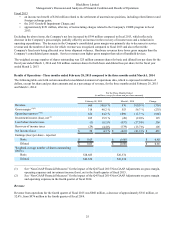

During fiscal 2014, approximately 20.5 million BlackBerry smartphones were sold through to end customers, which included

shipments made and recognized prior to fiscal 2014 and which reduced the Company's inventory in channel. Of the devices that

sold through to end customers in fiscal 2014, approximately 15.5 million were BlackBerry 7 devices. The number of

BlackBerry smartphones that were sold through to end customers was 36.1 million in fiscal 2013.

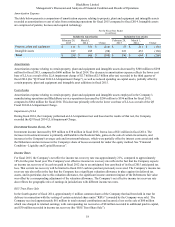

Service Revenue

Service revenue decreased by $1.2 billion, or 31.0%, to $2.7 billion, or 39.6% of consolidated revenue, in fiscal 2014,

compared to $3.9 billion, or 35.3% of consolidated revenue, in fiscal 2013. Service revenue in fiscal 2014 included

approximately $36 million relating to cash payments received on account of previously deferred service revenue from carriers

in Venezuela. The decrease in service revenue was primarily attributable to a lower number of BlackBerry users and lower

revenue from those users compared to fiscal 2013, and also reflected a service revenue deferral related to carriers in Venezuela

(the “Fiscal 2014 Venezuela Service Revenue Deferral”) and a service revenue deferral related to carriers in Argentina (the Q4

“Fiscal 2014 Argentina Service Revenue Deferral”), as discussed below.

The year-over-year decrease also resulted from a continued shift in the mix of the Company’s customers from higher-tiered

unlimited plans to prepaid and lower-tiered plans as well as pricing reduction programs implemented by the Company to

maintain the customer base. The number of BlackBerry customers continued to decline in fiscal 2014.

The Fiscal 2014 Venezuela Service Revenue Deferral was attributable to political and economic events in Venezuela, combined

with that country's foreign currency restrictions, resulting in the Company recognizing revenues on a cash basis in fiscal 2014.

The Company invoices its carrier partners in Venezuela for service access fees in U.S. dollars, and foreign currency restrictions

implemented by the Venezuelan government have impacted the ability of the Company’s Venezuelan carrier partners to timely

obtain U.S. dollars. During fiscal 2014, the Company deferred service revenues associated with services rendered in fiscal

2014 of approximately $240 million. The Company also experienced similar currency-related issues in Argentina in the fourth

quarter of fiscal 2014, which led to the deterioration of collections from the carriers to whom the Company provides services.

As a result, the Company recorded the Q4 Fiscal 2014 Argentina Service Revenue Deferral of approximately $13 million of

service revenue associated with service access fees charged to customers in Argentina in the fourth quarter of fiscal 2014.

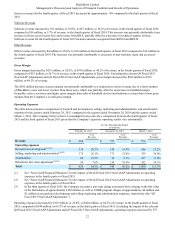

Software Revenue

Software revenue, which included fees from licensed BES software, client access licenses, technical support, maintenance,

upgrades and QNX software licensing revenues decreased by $26 million, or 10.0%, to $235 million, or 3.5% of consolidated

revenue, in fiscal 2014, compared to $261 million, or 2.4% of consolidated revenue, in fiscal 2013. The decrease was primarily

attributable to decreases in technical support and client access license revenues, partially offset by an increase in QNX revenue.

Other Revenue

Other revenue, which included non-warranty repairs, accessories, licensing revenues and gains and losses on revenue hedging

instruments, decreased by $159 million, or 62.6% to $95 million, or 1.4% in fiscal 2014 compared to $254 million, or 2.3% in

fiscal 2013. The decrease was primarily attributable to non-warranty repair revenue and also reflected gains on revenue hedging

instruments experienced in fiscal 2013 and not repeated in fiscal 2014 as well as decreases in licensing and accessory revenues.

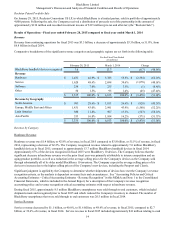

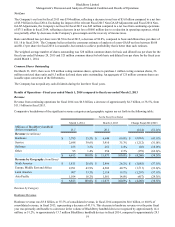

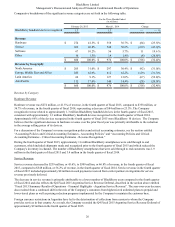

Revenue by Geography

North America Revenues

Revenues in North America were $1.8 billion or 26.6% of consolidated revenue in fiscal 2014, reflecting a decrease of $1.1

billion compared to $2.9 billion, or 26.2% of consolidated revenue in fiscal 2013. The decrease in North American revenue was

primarily attributable to a decrease in revenue from the United States, which represented approximately 19.4% of total

consolidated revenue in fiscal 2014, compared to 20.2% of total consolidated revenue in fiscal 2013, as a result of the intensely

competitive dynamics within the United States. Sales in Canada represented approximately 7.2% of the consolidated revenue.

Revenues in the United States continued to decline and subscriber attrition remained high due to the intense competition faced

by the Company in this market, consumer preferences for devices with access to the broadest number of applications, such as