Blackberry 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

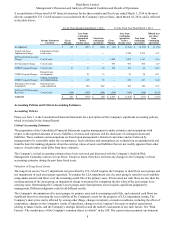

BlackBerry Limited

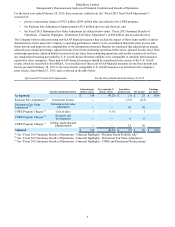

Management’s Discussion and Analysis of Financial Condition and Results of Operations

16

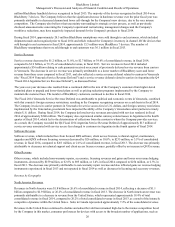

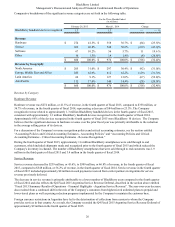

intense competition and a reduction in service revenue. Sales in North America have also been impacted by the significant

number of new Android based competitors that have entered the market.

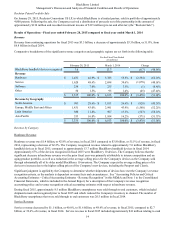

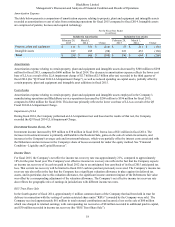

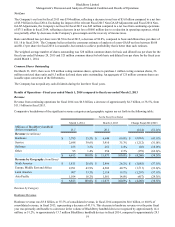

Europe, Middle East and Africa Revenues

Revenues in Europe, Middle East and Africa were $1.4 billion or 43.0% of revenue in fiscal 2015, reflecting a decrease of $1.6

billion compared to $3.0 billion or 43.9% of revenue in fiscal 2014. The Company believes that the decrease in revenues is due

to the same factors discussed above related to the decrease in North America revenues.

The Company's largest markets in this region include the United Kingdom, South Africa and Germany.

Latin America Revenues

Revenues in Latin America were $380 million or 11.4% of revenue in fiscal 2015, reflecting a decrease of $527 million

compared to $907 million or 13.3% of revenue in fiscal 2014. The Company believes that the decrease in revenues is due to the

same factors discussed above related to the decrease in North America revenues. The decrease is also attributable to the

Argentina currency restrictions discussed in the section entitled “Fiscal 2015 Summary Results of Operations - Financial

Highlights - Argentina Service Revenue”.

The Company's largest markets in this region include Argentina, Mexico and Venezuela.

Asia Pacific Revenues

Revenues in Asia Pacific were $533 million or 16.0% of revenue in fiscal 2015, reflecting a decrease of $571 million compared

to $1.1 billion or 16.2% of revenue in fiscal 2014. The Company believes that the decrease in revenues is due to the same

factors discussed above related to the decrease in North America revenues.

The Company's largest markets in this region include Indonesia, India and Hong Kong.

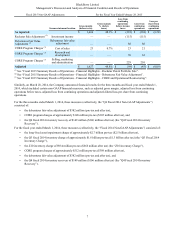

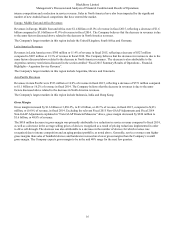

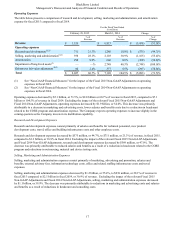

Gross Margin

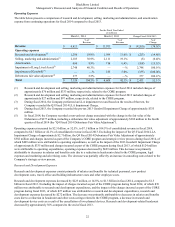

Gross margin increased by $1.6 billion or 3,830.2%, to $1.6 billion, or 48.1% of revenue, in fiscal 2015, compared to $(43)

million, or (0.6)% of revenue, in fiscal 2014. Excluding the relevant Fiscal 2015 Non-GAAP Adjustments and Fiscal 2014

Non-GAAP Adjustments explained in “Non-GAAP Financial Measures” above, gross margin decreased by $810 million to

$1.6 billion, or 48.8% of revenue.

The $810 million decrease in gross margin was primarily attributable to a reduction in service revenue compared to fiscal 2014,

as well as a decrease in the average selling prices of devices recognized as a result of pricing reductions implemented in order

to drive sell-through. The decrease was also attributable to a decrease in the number of devices for which revenue was

recognized due to intense competition and an aging product portfolio, as noted above. Generally, service revenues earn higher

gross margins than sales of handheld devices and hardware revenues have lower gross margins than the Company’s overall

gross margin. The Company expects gross margin to be in the mid 40% range for the next few quarters.