Blackberry 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

7

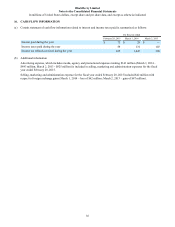

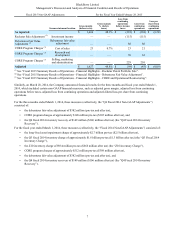

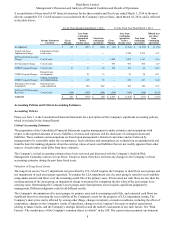

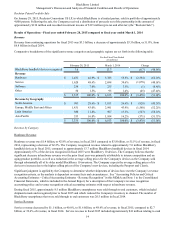

Fiscal 2015 Non-GAAP Adjustments For the Fiscal Year Ended February 28, 2015

Income statement location Gross margin

(before taxes)

Gross margin

% (before

taxes)

Loss from

continuing

operations

before income

taxes

Loss from

continuing

operations

Loss per

share from

continuing

operations

As reported $ 1,604 48.1% $ (385) $ (304) $ (0.58)

Rockstar Sale Adjustment (1) Investment income — — (115)(115)

Debentures Fair Value

Adjustment (2) Debentures fair value

adjustment — — 80 80

CORE Program Charges (3) Cost of sales 23 0.7% 23 21

CORE Program Charges (3) Research and

development — — 70 63

CORE Program Charges (3) Selling, marketing

and administration — — 229 210

Adjusted $ 1,627 48.8% $ (98) $ (45) $ (0.09)

(1) See “Fiscal 2015 Summary Results of Operations - Financial Highlights - Rockstar Patent Portfolio Sale”.

(2) See “Fiscal 2015 Summary Results of Operations - Financial Highlights - Debentures Fair Value Adjustment”.

(3) See “Fiscal 2015 Summary Results of Operations - Financial Highlights - CORE and Operational Restructuring”.

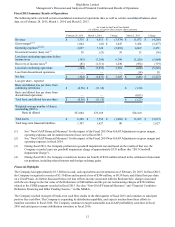

Similarly, on March 28, 2014, the Company announced financial results for the three months and fiscal year ended March 1,

2014, which included certain non-GAAP financial measures, such as adjusted gross margin, adjusted loss from continuing

operations before taxes, adjusted loss from continuing operations and adjusted diluted loss per share from continuing

operations.

For the three months ended March 1, 2014, these measures (collectively, the “Q4 Fiscal 2014 Non-GAAP Adjustments”)

consisted of:

• the debentures fair value adjustment of $382 million (pre-tax and after tax),

• CORE program charges of approximately $148 million pre-tax ($105 million after tax), and

• the Q4 fiscal 2014 inventory recovery of $149 million ($106 million after tax) (the “Q4 Fiscal 2014 Inventory

Recovery”).

For the fiscal year ended March 1, 2014, these measures (collectively, the “Fiscal 2014 Non-GAAP Adjustments”) consisted of:

• the long-lived asset impairment charge of approximately $2.7 billion pre-tax ($2.5 billion after tax),

• the Q3 fiscal 2014 inventory charge of approximately $1.6 billion pre-tax ($1.3 billion after tax) (the “Q3 Fiscal 2014

Inventory Charge”),

• the Z10 inventory charge of $934 million pre-tax ($666 million after tax) (the “Z10 Inventory Charge”),

• CORE program charges of approximately $512 million pre-tax ($398 million after tax),

• the debentures fair value adjustment of $382 million (pre-tax and after tax), and

• the Q4 fiscal 2014 inventory recovery of $149 million ($106 million after tax) (the “Q4 Fiscal 2014 Inventory

Recovery”).