Vodafone 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

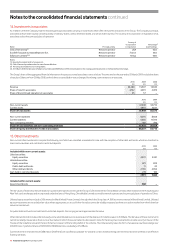

92 Vodafone Group Plc Annual Report 2010

Notes to the consolidated nancial statements continued

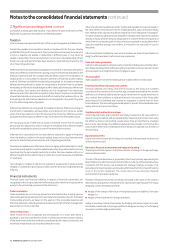

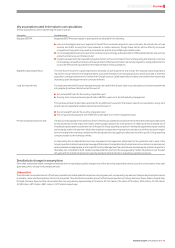

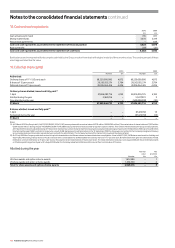

10. Impairment

Impairment losses, net

The net impairment losses recognised in the consolidated income statement, as a separate line item within operating profit, in respect of goodwill and licences and spectrum

fees are as follows:

2010 2009 2008

Cash generating unit Reportable segment £m £m £m

India India 2,300 – –

Spain Spain –3,400 –

Turkey Other Africa and Central Europe (200) 2,250 –

Ghana Other Africa and Central Europe –250 –

2,100 5,900 –

Year ended 31 March 2010

The net impairment losses were based on value in use calculations. The pre-tax adjusted discount rate used in the most recent value in use in the year ended 31 March 2010

calculation are as follows:

Pre-tax adjusted

discount rate

India 13.8%

Turkey 17.6%

India

During the year ended 31 March 2010 the goodwill in relation to the Group’s operations in India was impaired by £2,300 million primarily due to intense price competition

following the entry of a number of new operators into the market. The pre-tax risk adjusted discount rate used in the previous value in use calculation at 31 March 2009

was 12. 3%.

Turkey

During the year ended 31 March 2010 impairment losses of £200 million, previously recognised in respect of intangible assets in relation to the Group’s operations in Turkey,

were reversed. The reversal was in relation to licences and spectrum and was as a result of favourable changes in the discount rate. The cash flow projections within the

business plans used for impairment testing were substantially unchanged from those used at 31 March 2009. The pre-tax risk adjusted discount rate used in the previous

value in use calculation at 31 March 2009 was 19.5%.

Year ended 31 March 2009

The impairment losses were based on value in use calculations. The pre-tax adjusted discount rate used in the most recent value in use in the year ended 31 March 2009

calculation are as follows:

Pre-tax adjusted

discount rate

Spain 10.3%

Turkey(1) 19.5%

Ghana 26.9%

Note:

(1) The pre-tax adjusted discount rate used in the value in use calculation at 30 September 2008 was 18.6%.

Spain

During the year ended 31 March 2009 the goodwill in relation to the Group’s operations in Spain was impaired by £3,400 million following a fall in long-term cash flow

forecasts resulting from the economic downturn. The pre-tax risk adjusted discount rate used in the previous value in use calculation at 31 January 2008 was 10.6%.

Turkey

During the year ended 31 March 2009 the goodwill and other intangible assets in relation to the Group’s operations in Turkey was impaired by £2,250 million. At 30 September

2008 the goodwill was impaired by £1,700 million following adverse movements in the discount rate and adverse performance against previous plans. During the second

half of the 2009 financial year, impairment losses of £300 million in relation to goodwill and £250 million in relation to licences and spectrum resulted from adverse changes

in both the discount rate and a fall in the long-term GDP growth rate. The cash flow projections within the business plans used for impairment testing were substantially

unchanged from those used at 30 September 2008. The pre-tax risk adjusted discount rate used in the previous value in use calculation at 31 January 2008 was 16.2%.

Ghana

During the year ended 31 March 2009 the goodwill in relation to the Group’s operations in Ghana was impaired by £250 million following an increase in the discount rate.

The cash flow projections within the business plan used for impairment testing was substantially unchanged from the acquisition business case in 2008.

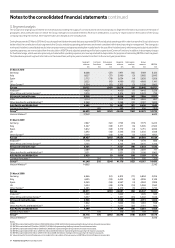

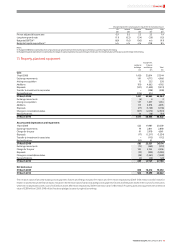

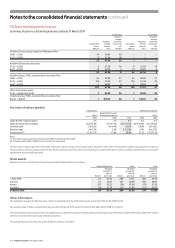

Goodwill

The carrying value of goodwill at 31 March was as follows:

2010 2009

£m £m

Germany 12,301 12,786

Italy 14,786 15,361

Spain 10,167 10,561

37,254 38,708

Other 14,584 15,250

51,838 53,958