Vodafone 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2010 109

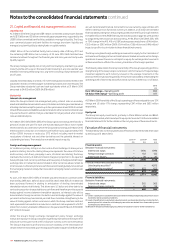

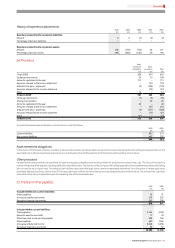

23. Post employment benets

Background

At 31 March 2010 the Group operated a number of pension plans for the benefit

of its employees throughout the world which vary depending on the conditions

and practices in the countries concerned. The Group’s pension plans are provided

through both defined benefit and defined contribution arrangements. Defined

benefit schemes provide benefits based on the employees’ length of pensionable

service and their final pensionable salary or other criteria. Defined contribution

schemes offer employees individual funds that are converted into benefits at the

time of retirement.

The Group’s principal defined benefit pension scheme in the United Kingdom, a tax

approved final salary scheme which was closed to new entrants from 1 January

2006, was closed to future accrual by current members on 31 March 2010. The assets

of the scheme are held in an external trustee administered fund. In addition, the

Group operates defined benefit schemes in Germany, Ghana, Greece, India, Ireland,

Italy, Turkey and the United States. Defined contribution pension schemes are

currently provided in Australia, Egypt, Greece, Hungary, Ireland, Italy, Kenya, Malta,

the Netherlands, New Zealand, Portugal, South Africa, Spain and the United Kingdom.

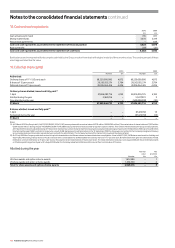

Income statement expense

2010 2009 2008

£m £m £m

Defined contribution schemes 110 73 63

Defined benefit schemes 50 40 28

Total amount charged to the income

statement (note 32) 160 113 91

Dened benet schemes

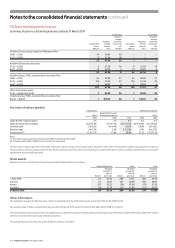

The principal actuarial assumptions used for estimating the Group’s benefit

obligations are set out below:

2010(1) 2009(1) 2008(1)

% % %

Weighted average actuarial

assumptions used at 31 March:

Rate of inflation 3.5 2.6 3.1

Rate of increase in salaries 4.6 3.7 4.3

Rate of increase in pensions in payment

and deferred pensions 3.5 2.6 3.1

Discount rate 5.7 6.3 6.1

Expected rates of return:

Equities 8.5 8.4 8.0

Bonds(2) 5.1 5.7 4.4

Other assets 2.8 3.7 1.3

Notes:

(1) Figures shown represent a weighted average assumption of the individual schemes.

(2) For the year ended 31 March 2010 the expected rate of return for bonds consisted of a 5.5% rate

of return for corporate bonds (2009: 6.1%; 2008: 4.7%) and a 4.0% rate of return for government

bonds (2009: 4.0%; 2008: 3.5%).

The expected return on assets assumptions are derived by considering the expected

long-term rates of return on plan investments. The overall rate of return is a weighted

average of the expected returns of the individual investments made in the group

plans. The long-term rates of return on equities and property are derived from

considering current risk free rates of return with the addition of an appropriate future

risk premium from an analysis of historic returns in various countries. The long-term

rates of return on bonds and cash investments are set in line with market yields

currently available at the statement of financial position date.

Mortality assumptions used are consistent with those recommended by the

individual scheme actuaries and reflect the latest available tables, adjusted for the

experience of the Group where appropriate. The largest scheme in the Group is the

UK scheme and the tables used for this scheme indicate a further life expectancy for

a male/female pensioner currently aged 65 of 22.3/25.4 years (2009: 22.0/24.8

years, 2008: 22.0/24.8 years) and a further life expectancy from age 65 for a male/

female non-pensioner member currently aged 40 of 24.6/27.9 years (2009:

23.2/26.0 years, 2008: 23.2/26.0 years).

Measurement of the Group’s defined benefit retirement obligations are particularly

sensitive to changes in certain key assumptions including the discount rate. An

increase or decrease in the discount rate of 0.5% would result in a £172 million

decrease or a £199 million increase in the defined benefit obligation respectively.

Charges made to the consolidated income statement and consolidated statement

of comprehensive income (‘SOCI’) on the basis of the assumptions stated above are:

2010 2009 2008

£m £m £m

Current service cost 29 46 53

Interest cost 77 83 69

Expected return on pension assets (76) (92) (89)

Curtailment/settlement 20 3(5)

Total included within staff costs 50 40 28

Actuarial losses recognised in the SOCI 149 220 47

Cumulative actuarial losses recognised

in the SOCI 496 347 127