Vodafone 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

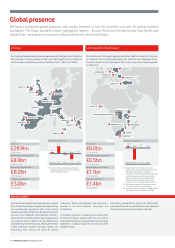

Price

Minutes

2008

(16.8) (12.5) (21.8)

24.0

12.4

22.7

2009 2010

130 120

93

45 54

69

48

Eastern

Europe

Western

Europe USA/

Canada

Other

Asia

Pacific

Africa

India China

Other Asia Pacific

Africa

Other

China

India

USA/Canada

Eastern Europe

Western Europe

519

480

309

525

725

866

464

764

4 Vodafone Group Plc Annual Report 2010

Telecommunications

industry

There are 4.7 billion mobile customers across

the globe with growth of around 20% per

annum over the last three years. The majority

of customers are in emerging markets such

as India and China. Vodafone is a leading

company with a 7% share of the global market.

Global mobile penetration is around 70% and

is generally higher in more mature markets

such as Europe and the United States but is

growing most quickly in emerging markets

such as India, China and Africa.

Ongoing competitive and regulatory

pressures have contributed to significant

reductions in mobile prices which are being

partly offset by higher mobile usage.

At a glance

The telecommunications industry has grown rapidly in size to provide essential services that facilitate a fundamental

human need to communicate.

Mobile customers (m) Vodafone outgoing voice prices and minutes (%)Mobile penetration at December 2009 (%)

Customers Mobile penetration Competition and regulation

Industry global

mobile customers

4.7bn

The industry has 4.7 billion mobile customers across

the globe, up from 2.7 billion in 2006.

Consumers are increasingly choosing to make voice

calls over mobile rather than fixed phones and mobile

calls accounted for 70% of all phone calls made in 2009

compared to 50% in 2006. As a result the number of

mobile users now far exceeds the number of fixed

telephones (1.3 billion).

Over the last three years mobile customer growth

has been strongest in emerging markets such as India

and China. In contrast growth has been more muted

in developed regions such as Europe which are

relatively mature..

Mobile penetration (the proportion of the population

that have a mobile) has grown to around 70% from 40%

in December 2006.

Looking forward the number of worldwide mobile phone

users is expected to continue to grow strongly. Most of

this growth is expected in emerging markets such as

India, China and Africa where mobile penetration is around

50% compared to about 130% in mature markets such

as Europe.

Developing countries are generally expected to deliver

faster GDP growth which combined with relatively little

alternative fixed line infrastructure is positive for mobile

penetration growth prospects.

Competition in the telecommunications industry

is intense. Consumers have a large choice of

communication offers from established mobile and

fixed line operators. Newer competitors, including

handset manufacturers, internet based companies

and software providers, are also entering the market

offering converged communication services.

Industry regulators continue to impose lower mobile

termination rates (the fees mobile companies charge for

calls received from other companies’ networks) and

lower roaming prices. Termination fees and roaming

charges accounted for 17% of Group revenue in 2010.

The combination of competition and regulatory

pressures have contributed to a 17% per annum decline

in the average price per minute across our global

network over the last three years. However price

pressures are being partly offset by increased usage.

During the year our customers spoke for an average

of 191 minutes per month compared to 137 in 2007.