Vodafone 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

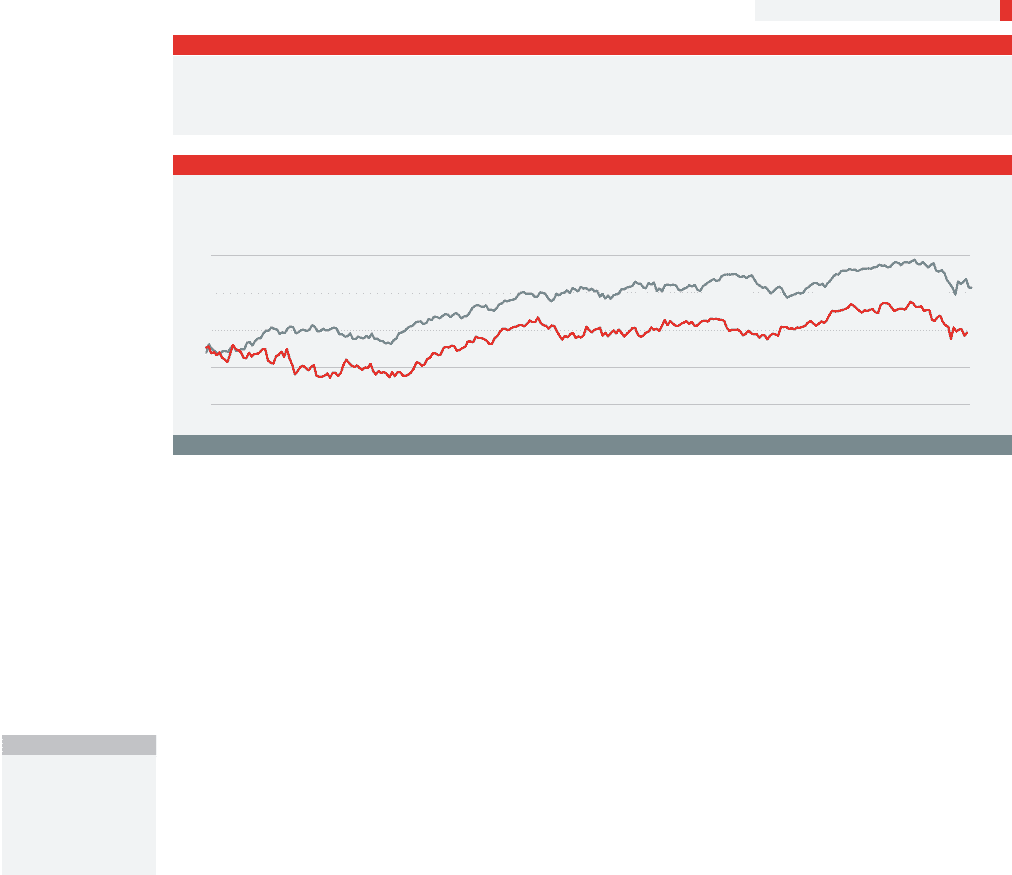

― FTSE 100 index― Vodafone Group

May 2010April 2009

100

120

140

160

180

3000

3750

4500

5250

6000

Vodafone Group Plc Annual Report 2010 3

Geographic diversity

Wide portfolio of operations including developed and

emerging markets.

In emerging markets growth prospects remain positive.

We now have over 100 million customers in our key

Indian market.

One of the benefits of our broad spread of operations in both

developed and emerging markets is the diversification of risk that this

allows. The Board keeps a close watch on this portfolio of investments,

particularly those where we do not exercise management control. In

Verizon Wireless we have an outstanding asset whose value has

increased substantially over recent years, and SFR has secured a

strong market position and provided good dividends. The Board

reviews these investments regularly and will remain focused upon the

best way of realising maximum shareholder value.

The impairment of our investment in Vodafone Essar in India was a

major disappointment to the Board. It results from an intense price war,

triggered by the unprecedented and unforeseeable entry of six new

competitors into the Indian market. Our operational performance in

India however remains strong and we remain confident in the long-

term prospects for the Indian market. We recently passed a very

important milestone, with Vodafone Essar now having more than 100

million customers – one of only five national mobile operators in the

world to have reached this scale, reflecting strong growth from 28

million customers when we acquired control of Vodafone Essar in May

2007. Elsewhere in the emerging markets, the operational turnaround

of our company in Turkey has yielded very positive results and we have

seen good progress in Ghana.

Your Board

This year we conducted an evaluation on the effectiveness of the

Board and its Committees aided by the external advisors MWM

Consulting. They concluded that the Board was effective, had the right

composition and skills and was generally performing well. More detail

is contained at page 48 of this report.

Simon Murray, who has been a non-executive Director since July 2007,

has decided to step down from the Board after this year’s AGM.

His knowledge of telecommunications, entrepreneurial spirit, and

experience of the Asia Pacific region have been great assets to the

Board, and I am grateful for the contribution he has made.

The Vodafone Foundation

The Vodafone Foundation supports communities and societies

in the countries in which we operate.

Vodafone invested a total of £42 million in foundation

programmes and social causes.

We have continued to fund the work of the Vodafone Foundation.

Through the Vodafone Foundation and our network of national affiliate

foundations we support communities and societies in the countries in

which we operate. In this financial year we invested a total of £42 million

in foundation programmes and social causes, and our World of

Difference programme enabled 604 people to take paid time to work

for a charitable purpose of their choice in their own community or in a

developing country. Across the Group we have also put in place

mechanisms to make it easy for our customers to give money to support

charitable appeals following disasters. After the Haiti earthquake,

Vodafone foundations donated £0.3 million to the emergency relief and

reconstruction effort, and we helped our customers in 14 countries to

give a total of £4.7 million by text message.

Summary

On behalf of the Board, I would like to thank all Vodafone staff around

the world for the great efforts they have made in the past year in such

challenging economic conditions. Vodafone would not have been able

to deliver these results without the tremendous effort of the team.

The Board is heartened by your Company’s strong results especially in

the face of such a sharp economic downturn. It believes that the Group

is well positioned to benefit from economic recovery and looks to the

future with confidence.

Sir John Bond

Chairman

Executive summary

Vodafone +13% FTSE 100 +39%

Total shareholder return April 2009 to May 2010

Vodafone share price vs FTSE 100

Proportionate mobile

customers

341.1m

up 12.7%