Vodafone 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2010 127

Additional information

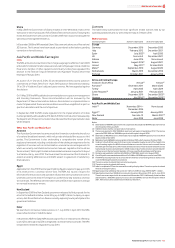

Shareholders at 31 March 2010

Number of % of total

Number of ordinary shares held accounts issued shares

1 – 1,000 435,142 0.21

1,001 – 5,000 80,280 0.31

5,001 – 50,000 26,783 0.58

50,001 – 100,000 1,130 0.14

100,001 – 500,000 1,066 0.43

More than 500,000 1,663 98.33

546,064 100.00

Geographical analysis of shareholders

At 31 March 2010 approximately 48.8% of the Company’s shares were held in the UK,

27.4% in North America, 16.4% in Europe (excluding the UK) and 7.4% in the rest of

the world.

Major shareholders

BNY Mellon, as custodian of the Company’s ADR programme, held approximately 14%

of the Company’s ordinary shares of 113

/7 US cents each at 17 May 2010 as nominee.

The total number of ADRs outstanding at 17 May 2010 was 740,793,229. At this date

1,313 holders of record of ordinary shares had registered addresses in the United States

and in total held approximately 0.006% of the ordinary shares of the Company. At 17

May 2010 the following percentage interests in the ordinary share capital of the

Company, disclosable under the Disclosure and Transparency Rules, (DTR 5), have been

notified to the directors:

Shareholder Shareholding

Black Rock Inc 5.74%

Legal & General Group Plc 4.07%

The rights attaching to the ordinary shares of the Company held by these

shareholders are identical in all respects to the rights attaching to all the ordinary

shares of the Company. The directors are not aware, at 17 May 2010, of any other

interest of 3% or more in the ordinary share capital of the Company. The Company is

not directly or indirectly owned or controlled by any foreign government or any other

legal entity. There are no arrangements known to the Company that could result in

a change of control of the Company.

Articles of association and applicable English law

The following description summarises certain provisions of the Company’s articles

of association and applicable English law. This summary is qualified in its entirety by

reference to the Companies Act 2006 of England and Wales and the Company’s

articles of association. Information on where shareholders can obtain copies of the

articles of association is provided under “Documents on display” on page 129.

The Company is a public limited company under the laws of England and Wales. The

Company is registered in England and Wales under the name Vodafone Group Public

Limited Company with the registration number 1833679.

All of the Company’s ordinary shares are fully paid. Accordingly, no further

contribution of capital may be required by the Company from the holders of

such shares.

English law specifies that any alteration to the articles of association must be

approved by a special resolution of the shareholders.

Articles of association

Pursuant to the Companies Act 2006, a company can remove the object clauses

which become part of its articles of association and as a result the company’s objects

will be unrestricted.

A special resolution will be proposed at the 2010 AGM to i) remove the Company’s

object clause together with all other provisions of its memorandum which, by virtue

of the Companies Act 2006, are treated as forming part of the Company’s articles of

association and ii) adopt new articles of association in order to update the Company’s

existing articles of association to take account of the implementation on 3 August

2009 of the Shareholders’ Rights Regulations and the implementation of the

remaining parts of the Companies Act 2006.

The current authorised share capital comprises 68,250,000,000 ordinary shares of

113

/7 US cents each and 50,000 7% cumulative fixed rate shares of £1.00 each and

38,563,935,574 B shares of 15 pence each and 28,036,064,426 deferred shares of

15 pence each.

Ination and foreign currency translation

Inflation

Inflation has not had a significant effect on the Group’s results of operations and

financial condition during the three years ended 31 March 2010.

Foreign currency translation

The following table sets out the pounds sterling exchange rates of the other principal

currencies of the Group, being: “euros”, “€” or “eurocents”, the currency of the

European Union (‘EU’) Member states which have adopted the euro as their currency,

and “US dollars”, “US$”, “cents” or “¢”, the currency of the United States.

31 March %

Currency (=£1) 2010 2009 change

Average:

Euro 1.13 1.20 (5.8)

US dollar 1.60 1.72 (7.0)

At 31 March:

Euro 1.12 1.08 3.7

US dollar 1.52 1.43 6.3

The following table sets out, for the periods and dates indicated, the period end,

average, high and low exchanges rates for pounds sterling expressed in US dollars

per £1.00.

Year ended 31 March 31 March Average High Low

2006 1.74 1.79 1.92 1.71

2007 1.97 1.89 1.98 1.74

2008 1.99 2.01 2.11 1.94

2009 1.43 1.72 2.00 1.37

2010 1.52 1.60 1.70 1.44

Month High Low

November 2009 1.68 1.64

December 2009 1.67 1.59

January 2010 1.64 1.59

February 2010 1.60 1.52

March 2010 1.54 1.48

April 2010 1.55 1.52

Markets

Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange

and with effect from 29 October 2009 its listing of ADSs was transferred from the

NYSE to NASDAQ. The Company had a total market capitalisation of approximately

£71.8 billion at 17 May 2010 making it the third largest listing in The Financial Times

Stock Exchange 100 index and the 38th largest company in the world based on

market capitalisation at that date.

ADSs, each representing ten ordinary shares, are traded on NASDAQ under the

symbol ‘VOD’. The ADSs are evidenced by ADRs issued by BNY Mellon, as depositary,

under a deposit agreement, dated as of 12 October 1988, as amended and restated

on 26 December 1989, 16 September 1991, 30 June 1999, 31 July 2006 and 30 July

2009 between the Company, the depositary and the holders from time to time of

ADRs issued thereunder.

ADS holders are not members of the Company but may instruct BNY Mellon on the

exercise of voting rights relative to the number of ordinary shares represented by

their ADSs. See “Articles of association and applicable English law – Rights attaching

to the Company’s shares – Voting rights” on page 128.